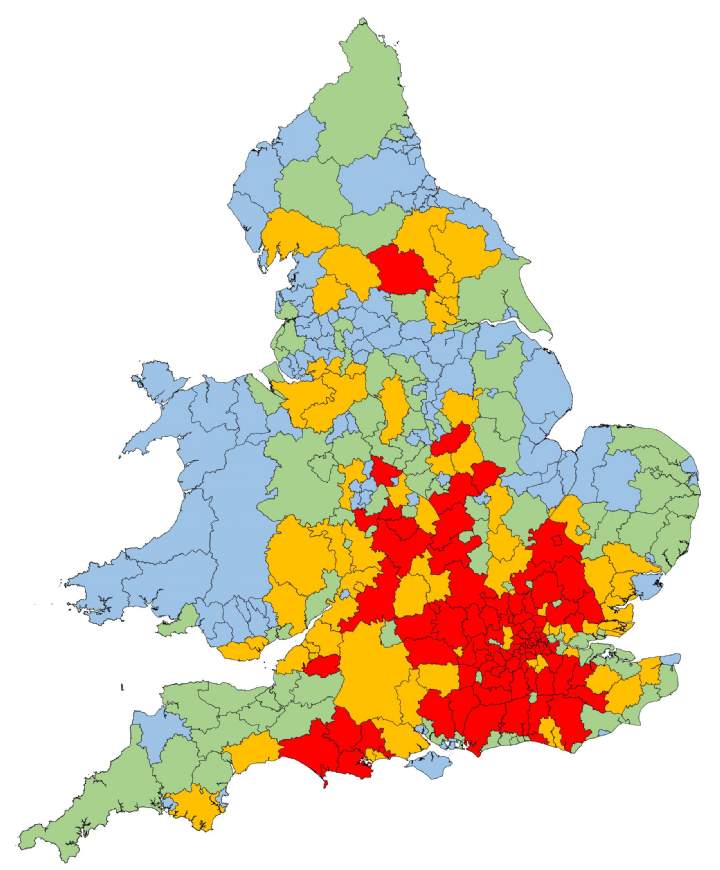

The combined value of homes in England and Wales owned by those aged over 65 totals nearly £2.0 trillion. 37 per cent of this wealth is located in London and the South East, even though the two regions account for only 25 per cent of all homes.

It’s no secret that previous generations in the UK were able to get a foot on the housing ladder at a much younger age and then benefited from strong house price growth. As a result, 42 per cent of total homeowner equity is held by those aged over 65. At the same time, the 2020 English Housing Survey revealed that 65 per cent of owner-occupied homes amongst those aged 65+ have a surplus of two or more bedrooms that they do not need or use, equating to around 3.5 million under-occupied homes.

While there is no shortage of equity among the target market for senior living homes, encouraging older homeowners to downsize into senior living is still a big challenge in the UK. In time, and with the new generation of Integrated Retirement Communities (IRCs), which offer a far superior product to what has come before, we expect demand to increase and in turn, accelerated delivery to follow.

This will also positively impact the wider residential housing market by freeing up much needed housing stock for growing families, sharers and those currently priced out of the market.

Often, real estate trends in the UK follow what has already happened in the USA. Across the Atlantic, the market saw increased demand for senior housing when the model expanded to be an aspirational residential and service-led model, offering hospitality services, attractive amenities and access to a continuum of care.

The rental IRC market in the UK is evolving, with Birchgrove and Auriens, for example, focusing solely on rental and many of the major players such as Inspired Villages and Retirement Villages Group delivering a range of housing types and tenures, including a small but increasing quantity of rental homes.

.jpg)