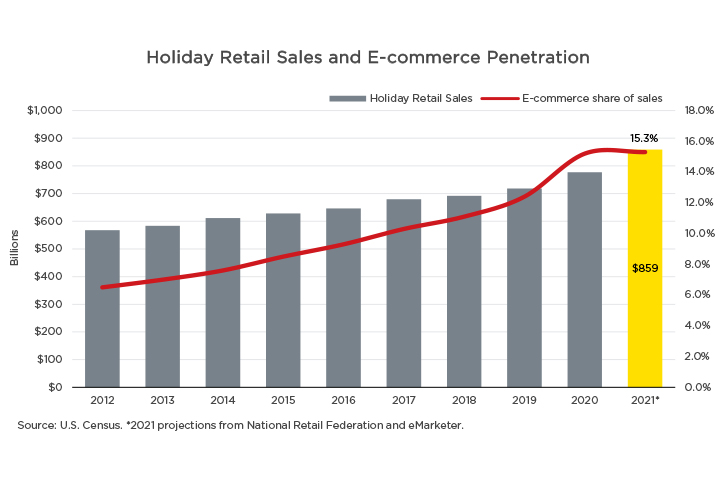

Despite headwinds from supply chain disruptions and a resurgence of Covid-19, U.S. retail sales between November 1 and December 24 were up 8.5% compared to 2020 according to preliminary data from Mastercard. With the holiday shopping rush now behind us, the biggest logistics challenge of the season is only just beginning. Referred to as reverse logistics, the messy return and repair process accounts for 10% of total supply chain costs. Two-thirds of consumers are expected to send back at least one gift and the overall return rate for retail purchases averages 10.6%. The e-commerce return rate is almost twice as high, averaging 18.1%. Record retail sales, including a growing share of online purchases, means that more returns than ever will be flooding warehouses in the coming weeks.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)