The financial technology, or fintech, industry is expected to play an important role as a real estate occupier group as Europe emerges from lockdown and occupier activity returns to a degree. Demand for office space from fintech companies over the coming years is likely to prove resilient because of structural changes to economies and banking sectors that have been taking place since the financial crisis of 2008. That makes the relative attractiveness of a city to locate fintech a key real estate issue going forward.

Savills has examined the world’s fintech sector and its potential impact on real estate markets in recent reports. Fintech companies include those involved in loans, payments, wealth or investment management, as well as software providers automating financial processes or addressing core business needs of financial firms, such as ATMs, electronic trading portals and point-of-sale software. What fintech is not are banks merely offering internet services or traditional retail lenders, asset managers and stock exchanges.

In a global study using data from PitchBook and Workthere (a wholly owned Savills subsidiary created to help clients look for flexible office space), Savills calculated that London has the most fintech headquarters of any city in the world at 1,033, followed by New York (939), San Francisco (593), Singapore (252), Paris (230) and Beijing (222). These global cities, the report said, “are the clear epicentres of the fintech world.” Prague’s total of fintech HQs is 34, though separate research suggests this is an underestimated figure and, consequently, undervalues the Czech capital’s attractiveness as a fintech hub.

Being a popular fintech HQ location is having a clear impact on the real estate markets of those cities. Fintech is a relatively young sub-sector of the tech sector, consisting of a high proportion of startups. These fast-growing companies naturally gravitate toward using flexible office space, which enables them to take more or less space as they need. This is reflected in a significant number of the fintech companies that received VC funding last year being based in this type of workspace.

These fintech companies are expected to impact the conventional office market over the coming years, as we have witnessed in London. As these early-stage companies grow their head count and become more established in their market, some will make the move from flexible to conventional offices, and perhaps even become major occupiers in their own right. Savills research indicates that fintech companies typically move office an average of 4.5 months after receiving VC funding.

Flirting with fintech

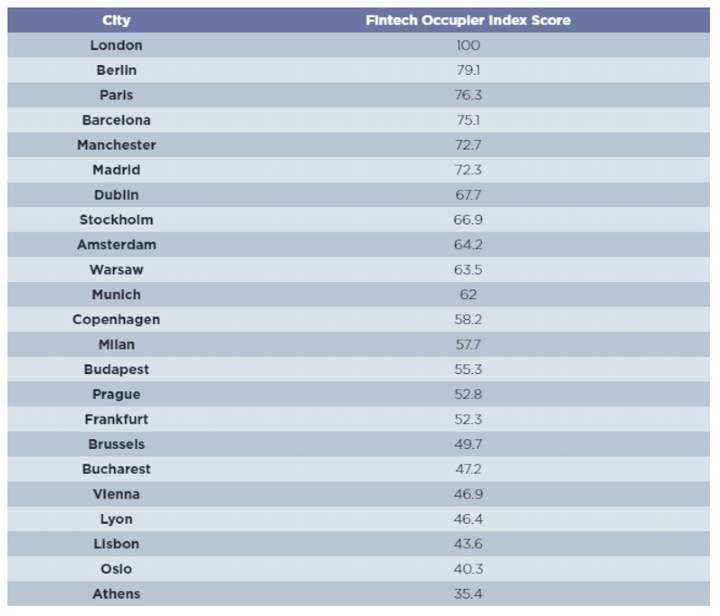

What makes a city attractive to fintech? In its European Fintech Occupier Outlook 2020 report, Savills ranked 23 cities for fintech, based on 16 occupier variables within three main criteria – demographics, talent & innovation, and affordability & business environment. The resulting Savills European Fintech Occupier Index rated London, Berlin, Paris, Barcelona and Manchester as the continent’s most attractive cities for fintech, as these combine existing financial services infrastructure, solid demographic fundamentals, strong talent and innovation, relative affordability and attractive business environments.

Prague was in 15th spot on the European Fintech Occupier Index, scoring poorly on some of the demographic fundamentals, including the forecasted 10-year growth of the professional, science and tech sectors, as well as innovation stats, including patents granted in 2019, the number of FT fastest growing companies in 2019, and the number of fintech companies compared to other European cities.

However, Prague scored strongly in the affordability and business environment criterion, given its relatively low corporate income tax rate (19%), low average total cost of employing a software engineer (€35,000 p.a.), and low prime rent costs (€285 per sq m), which could create further demand for office space as companies opt to “east-shore”.

Experts point out Prague offers other attractions for fintech. The city’s banking sector is second only to that of the Polish capital in Central Europe, there is a high share of ICT specialists among the workforce, and internet and smartphone penetration are high. Deloitte estimates that the Czech market in fintech services has the potential over the long term to be worth as much as CZK15 billion, compared with its present size of CZK3 billion to CZK8 billion.

Prague might not have the same number of fintech HQs as the global cities, but it certainly has the favourable conditions and environment to nurture more, if it can address its demographic weaknesses by, for example, attracting more foreign ICT graduates to work in the city.