J.P.Morgan’s “2019 Global Payments Trends Report”, published in July, forecasts the Czech Republic will have Europe’s fastest growing e-commerce market between 2017 and 2021. Czechs are already keen e-commerce users and with one of the highest levels of online stores per capita in Europe, this is sure to continue. However, the delivery system is still immature in the regions, where the greatest impact on the real estate market will be felt.

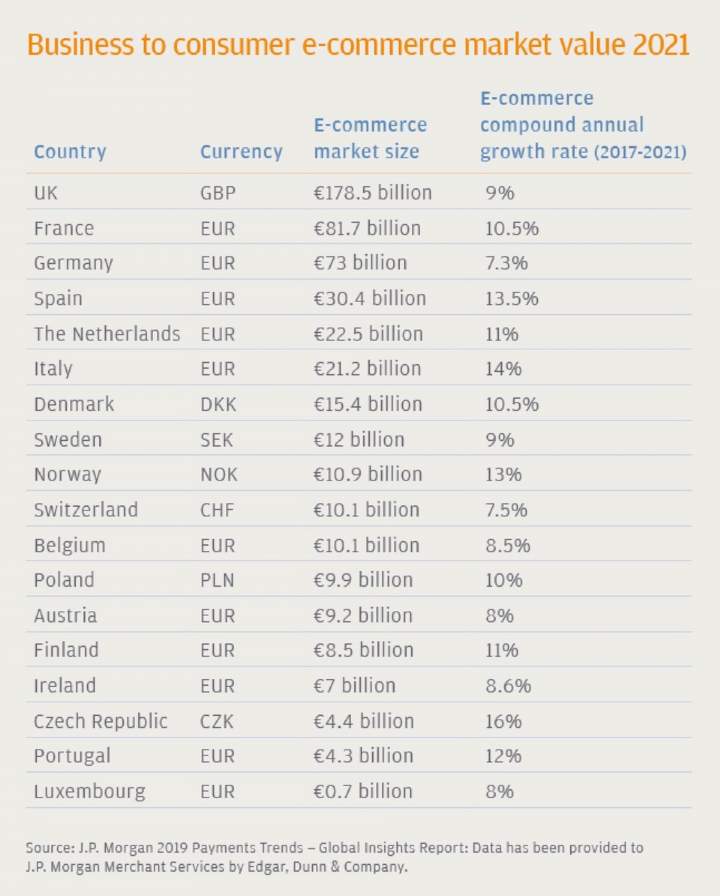

According to the J.P.Morgan report, e-commerce growth across the European region remains strong but uneven. It is slowing slightly in the more mature markets such as the United Kingdom and Germany while growing at double-digit rates in less-developed markets like the Czech Republic and Spain.

The US-based bank estimates the Czech Republic’s e-commerce market is worth today €4.4 billion – a figure that accounts for just 0.8 per cent of the overall European e-commerce market, but one that is projected to expand at a compound annual growth rate (CAGR) of 16 per cent between 2017 and 2021.

Underpinning this growth is the rise in the number of Czech online shops. J.P.Morgan says in 2017 the number of Czech e-shops increased by 3,900 to reach 40,100, meaning the country enjoys one of the highest levels of online stores per capita in Europe. The report also highlights the extraordinary growth of mobile as a shopping method, with the Czech Republic having Europe’s highest percentage of so-called ‘m-commerce’ spending at 54% of the total value of e-commerce transactions, followed by the UK at 51%.

.jpg)

.jpg)