Any hope that the current Brexit-related uncertainty would dissipate seems to have been lost to the wind and this appears to have affected market activity in the farmland market so far this year.

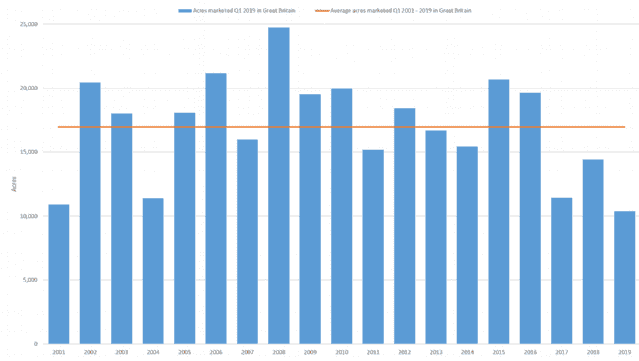

The market in the first quarter of any year tends to be relatively small as most sellers prefer to wait and launch their property in the spring – since 2000 the first quarter of the year has averaged just under 17,000 new acres to the market.

However, this year, at 10,400 acres across Britain, it is the lowest recorded since our records began in 1995 and probably since we began to trade farmland in this country (see graph, below).

The supply in the first quarter of this year was 28 per cent less than in the first quarter of 2018 and 40 per cent lower than the average since 2000. Indeed there have only been four years since 2000 when the area marketed in the first quarter was less than 12,000 acres.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)