International tourism is booming and with 713 million people travelling to and within Europe in 2018 (a 6 per cent rise on 2017’s numbers), the continent is the global leader of inbound travel, according to the United Nations’ World Tourism Organisation.

More travel means more overnight stays and, as a result, the European hotels and accommodation sector is going from strength to strength.

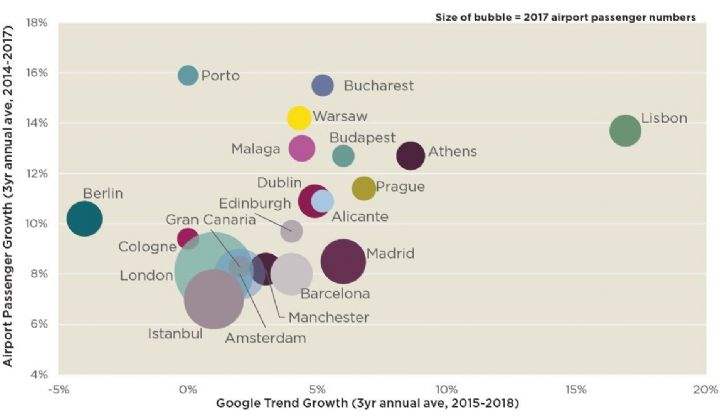

By analysing the top 20 markets on airport passenger growth, benchmarked against interest levels derived from travel-related Google searches, a number of potential future growth markets stand out, in particular those in South and Central Eastern Europe.

In the South, Porto and Lisbon, with its 300 days of sunshine a year, are the most notable, owing to recent airport expansion leading to passenger volumes increasing by 15.9 per cent and 13.7 per cent on average per annum respectively between 2014 and 2017.

Interest in Lisbon continues to excel, helped by the city playing host to a number of international events and, among other factors, its growing reputation as a ‘foodie’ destination. This has resulted in strong year-end revenue per available room (RevPAR) growth in 2018 of 7 per cent, off the back of the 21.8 per cent growth already experienced in 2017.

As a result, Portugal is seeing new market entrants with Latin-American hospitality brand Selina making its debut in Porto in October 2018, with a second property scheduled to open in the city by the end of 2020. Additionally, Portugal’s growing appeal is enticing further expansion amongst a number of global hotel brands including the likes of Wyndham Hotels & Resorts, Meliá and Eurostars.

The cluster of strong performing Central Eastern European markets features Budapest and Bucharest, each with rapidly advancing tourism markets that have been matched with substantial RevPAR growth in 2018.

According to data from the Hungarian Tourism Agency, commercial lodgings in the country recorded 12.5 million guests across 2018, increasing 5 per cent from the year prior, while tracking almost 31 million guest nights. Prague also ranks highly in terms of both airport passenger growth and interest levels.

There are several events on the horizon that will continue to open up Europe to new markets. A new airport for connections to Asia and the US is scheduled to open near Warsaw in 2027 and the delayed BER airport in Berlin is set to open in 2020. As a result, inbound tourism figures are expected to continue to grow, allowing the European hotels market to grow with it.

.jpg)

.jpg)

.jpg)