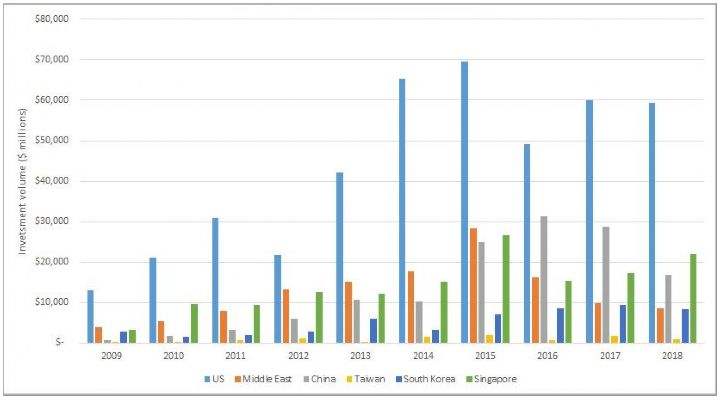

As the UK and mainland European markets continue to be bolstered by interest and investment from across the globe, it’s important to understand the prevailing sentiment from the key centres of demand. Here’s a snapshot of what we expect to see from various jurisdictions in the year ahead.

China

There’s likely to be little change in outbound capital policy in China and the existing capital controls will stay in place for at least the short term, continuing to impact the ability of Chinese companies to invest abroad. There are still a number of private individuals who could be active in the UK and continental Europe.

Singapore

Overall Singaporean investors think that today is a good time to enter the UK market as pricing has moved and looks compelling when set against what is achievable at home. However, for those that are yet to make their first purchase, it feels like a bold move to be chasing assets in the UK today given the political climate. As such some may be drawn to continental Europe instead.

South Korea

2018 was a significant year for Korean investment into Europe and London in particular, with over £3.2 billion of assets acquired in the British capital (Savills advised on 55 per cent of these deals).

We expect that mainland Europe will be the key focus this year, and we’ll see some big deals happen in Paris in H1. South Korean investors will continue to look at the tier one markets but they are showing a willingness to look at tier two or three markets as well given the compressed pricing environment, including assets in wider UK regional markets.

Taiwan

Outbound investment from Taiwan is back on the agenda following the surprise deal by Fubon in Frankfurt at the end of 2018. The locations of interest are Frankfurt, central London and, for some, Japan. Their requirements are generally unchanged as they seek core, quality product, with a long weighted average unexpired lease terms (WAULT), as few tenants as possible and market yields.

Middle East

There is a wait-and-see approach from many Middle Eastern investors in relation to the UK and Brexit. The expectation is that Middle Eastern investors will return to a normal activity level later this year and continue to be opportunity led and yield driven as well as being more active in continental European.

US

New York City office investment sales are rebounding and domestic investors and users are helping to fill the void left by mainland Chinese investors. There is reduced concern over the rising US interest rate environment. The US investors that don’t have an established track record, or UK footprint, don’t see a sufficient yield discount to compensate for the geo-political uncertainty when looking to invest in London, their traditional gateway into Europe.

Ultimately demand for the UK and Mainland Europe from investors across the globe continues to be strong. We expect that the statistics for 2019 will likely show a year of two halves from a UK (in particular London) perspective as the Brexit situation progresses. For mainland Europe we expect continued steady levels of investment, driven primarily by stock availability and pricing.

.jpg)

.jpg)