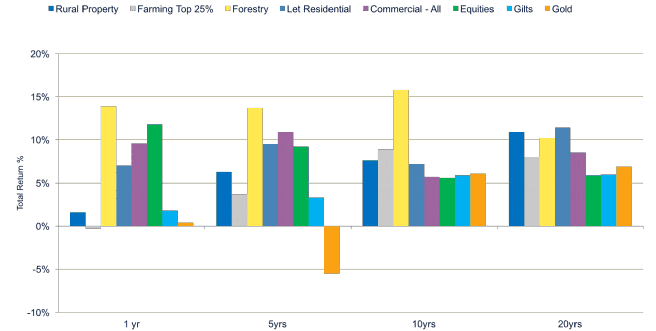

Rural estates whose assets include let land, residential, farms and forestry have been a comparable investment to other property assets and financial instruments during the past 20 years, delivering an average blended annualised total return of around 10 per cent (see table below).

During this time frame these assets were only outperformed by mainstream let residential portfolios where an annualised total return of 11.4 per cent was achieved.

Reducing the time frame to a decade the scenario for rural estates is pretty similar, albeit at a slightly lower level of blended return (8 to 9 per cent) with forestry the star performer. As a standalone asset it achieved a significant annualised total return of almost 16 per cent.

Reducing the time frame further, the performance of rural assets has weakened, mainly because of pressure on capital values of farmland. However, forestry, where the underlying fundamentals are based on the growing demand for sustainably produced timber required for house building around the world, continues to generate double-digit returns.

Holding rural assets long term comes with additional benefits beyond the pure financial performance, including taxation and ownership benefits. It is a tangible asset, a good inflation hedge and its performance is relatively recession proof.

This last point results in a low or negative correlation with other traditional asset classes such as stocks and bonds, providing an interesting portfolio diversification.

The mix of assets on rural estates is however fundamental to its income and investment performance. Although income generation and retention of the core estate are the key objectives for many estate owners and managers, the Agriculture Bill heralds a new era in the rural economy, challenging everything from tenancy arrangements to supply contracts.

Estates that spread risk and have a balanced asset portfolio that meets its performance objectives will be best placed to adapt to the changing structure of the rural economy. This might include identifying land and property in or near towns and cities or looking at opportunities overseas.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)