Where should core and value-add real estate investors currently be putting their money in Europe?

The short answer is offices, offices and offices. Office assets, office developments and office refurbishments all offer potential. This is unsurprising given the liquidity and transparency of the assets involved.

Offices is also currently the least disrupted sector of all the commercial property asset classes. The very nature of the last economic crisis has slowed down, if not stopped, development activity for financial reasons, leading to most core European markets to be undersupplied when the recovery came.

The sector is also currently boosted by business expansion, employment growth and a significant need for modern premises which was restrained during the crisis.

But beyond the limelight some interesting niche markets also warrant exploration. Due to the nature of the economy of some countries, their political focus or demographic changes, other asset classes including hospitality, the private rented sector (PRS), student housing or care homes in some specific markets, can offer investors great opportunities.

Overall rising trade volumes and expanding e-commerce are driving demand for logistics space and quality schemes are becoming scarce in most European countries, putting upward pressure on rents.

In the UK the retail segment is undergoing strong repricing, which will soon bring to the fore some prime opportunities for investors to find good value in the market. Retail sale and lease-back acquisitions are an alternative way to source property, notably in Spain and Italy as long as the retail tenant is showing they have a ‘future-proof’ strategy and their properties are in prime locations.

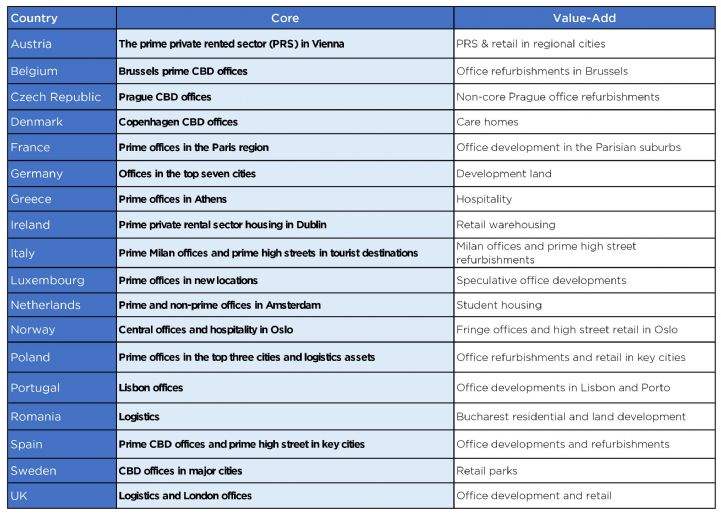

Below are our top core and value-add opportunities picks in each European market. For the detailed rationale behind each pick see our latest European Investment Market in Minutes report.

.jpg)

.jpg)

.jpg)