The estimated value of all the world’s homes has now reached US$220.2 trillion, equivalent to approximately £167.4 trillion at the time of writing.

With a total value exceeding £7 trillion (US$9 trillion), housing is indisputably the UK’s biggest store of wealth. But as our analysis shows, residential property is also the world’s largest asset class by a clear margin, equivalent in value to 3.5 times the total global GDP.

Residential value dwarfs the value of commercial and agricultural real estate, worth an estimated US$33.3 trillion and US$27.1 trillion respectively. Equities and debt securities combined fail to equate to the value of the world’s homes, while gold is worth US$7.6 trillion, a tiny 3.5 per cent fraction of total housing value.

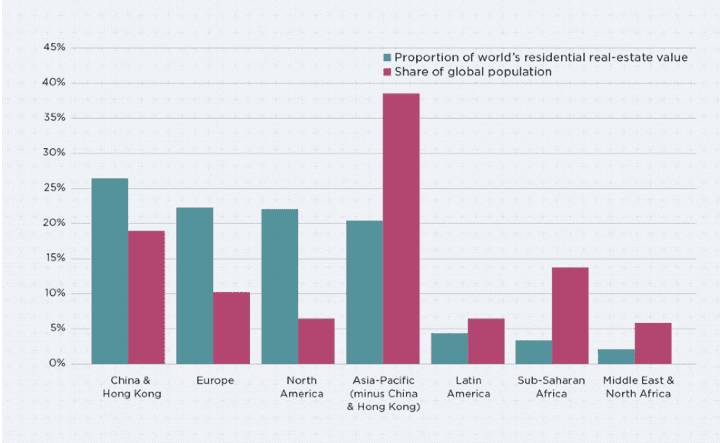

Unsurprisingly, most residential real estate value is located in the mature markets of North America and Europe, where the share of value far exceeds the share of global population.

But things are changing. Rapid house price growth and an expanding economy have boosted housing wealth in China and Hong Kong, which now account for some 26 per cent of housing value and 19 per cent of the world’s population.

The remainder of Asia Pacific, Latin America, Africa and the Middle East all account for a relatively low share of residential real estate value compared with their share of the world’s population, due to low house prices and large rural populations.

.jpg)

.jpg)

.jpg)

.jpg)

(1).jpg)

(1).jpg)

.jpg)