Sir Oliver Letwin MP has published his draft analysis of large housing site build out rates, identifying a lack of product diversity as the major limiting factor on delivery.

The Letwin Review was established to investigate the causes of the large gap between planning permissions and housing completions, and to make recommendations for closing it, focusing on the build out rates of large sites.

Product diversity

Sir Oliver’s key conclusion is that build out rates on very large sites are limited by the homogeneity of product. Major house builders should offer more variety in product type, tenure and design, which could result in more variation in pricing. This would make the new build market accessible to a greater number of people, thus increasing market capacity for open market sales.

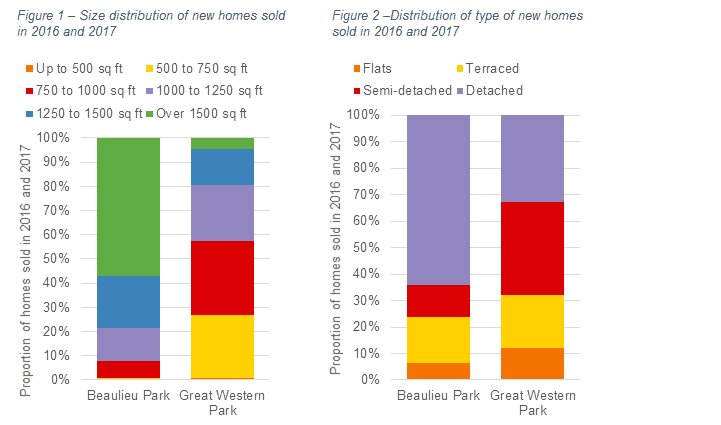

One example of the effect of product diversity is the difference in build out rate between Great Western Park (GWP) in Didcot and Beaulieu Park in Chelmsford. These two sites are of similar size (3,300 and 3,600 homes respectively) yet private sales have averaged at least 195 per year at GWP (between Q1 2015 and Q4 2017) compared with 120 homes per year at Beaulieu (between Q3 2016 and Q3 2017).

Higher sales rates have been achieved at GWP where there is a broader range of sizes and types of homes sold than at Beaulieu Park where there has been a focus on larger homes. GWP has also had multiple housebuilders onsite, while Beaulieu Park has been predominantly delivered by one developer.

.jpg)

(1).jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)