UK Build to Rent is a much talked about but ill-understood asset by the majority of investors. The chart below clarifies where Build to Rent sits within the broader residential market.

.png)

Simply put, ‘multifamily’ means blocks of apartments designed specifically to rent, while ‘single family’ means individual houses designed specifically to rent to individual families. ‘Permitted development’ are blocks that have been converted from an alternative use class to be privately rented. ‘Student housing’ is accommodation let to students either through direct lets or nomination agreements with universities.

The underlying catalyst for the sector is the ongoing housing crisis – a structural undersupply of homes, that shows little sign of abating in the mid to long term. In London, Savills analysis shows that 66,000 households a year are needed in order to meet current housing needed, but only 39,500 a year (2017) are currently being built. Demographics, tenure shift, affordability of buying, political environment and competitive risk-adjusted returns all underpin the sector’s appeal to investors.

The performance of student housing and multifamily in the US has given institutional investors comfort in the asset class, resulting in increased interest in the UK market. Since M&G’s acquisition of the Berkeley residential portfolio in 2013, the mind-set of investors has changed. This, combined with a stronger focus on income yield across all asset classes, has investors eyeing the favourable returns available from purpose-built assets, especially when compared with traditional sectors.

The biggest owners of built-to-rent stock include Get Living, Sigma Capital, L&Q and M&G Real Estate. Quintain’s Wembley Park development stands out, with its pipeline of 8,054 residential units. Given the sophistication of the investors targetting the sector, we will see the investor landscape grow in the coming years. As an indication of growth, the last year has seen the amount of operational multifamily stock increase by 45 per cent, while 2.7 billion of multifamily assets has been traded, a 23 per cent increase over 2016.

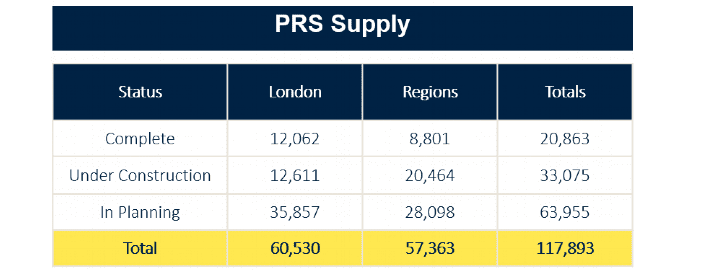

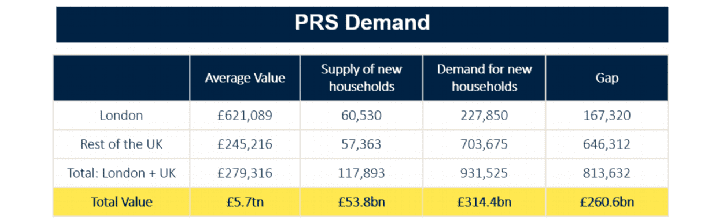

Private rented sector (PRS) demand massively exceeds supply (see table below). The gap between supply and demand stands at over 800,000 homes, around 170,000 of which are in London, the rest spread across the UK.

Demand is high but economies of scale are crucial to optimising asset performance. Investors able to keep operating costs under control and spread them over a wider unit base, will likely be the outperformers. Asset selection and location will be essential to this process.

.jpg)

.jpg)

.jpg)

.jpg)

(1).jpg)

.jpg)