Investors looking for a diversified product with good long-term credentials should consider forestry as an alternative 100 per cent land-backed investment.

Forest assets combine the production of timber and the security of land ownership with a unique benefit – that of adding year-on-year capital value as the store of timber on a site matures. Return on investment is realised either from capital growth and the subsequent sale of assets, or from the harvesting and sale of timber at maturity.

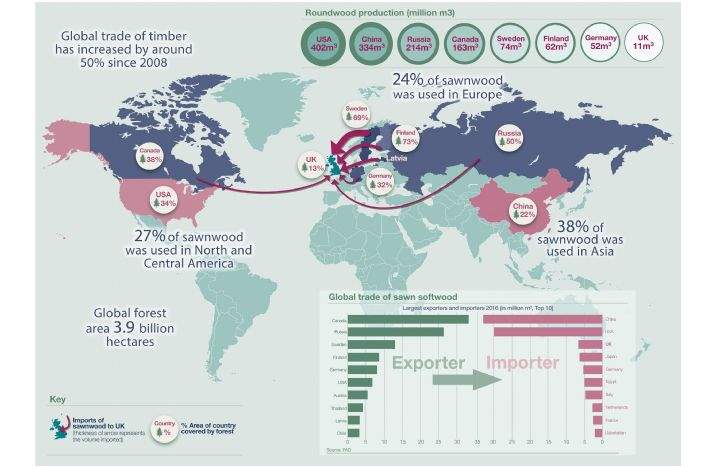

Future value is pegged to the price of timber, which is currently forecast to rise through demand-driven inflation as the stock of sustainably harvestable wood comes under pressure from the rising global population and demand from housebuilders.

There are investment opportunities across the world, but UK forests are an increasingly sought after asset class, benefiting from good growth rates, a tax efficient environment and a well-developed wood processing industry.

The latter is going through a period of inward investment in order to install state-of-the-art mills across the country. The UK is the third largest importer of wood products and with domestic production at fairly constant levels, this dependency on imports means global pricing trends will be influential.

Recent UK forest performance has been excellent, with the long-term annualised total return calculated at 9 per cent, so competing favourably with other asset classes. Returns could come under pressure as demand for the asset grows, but growing timber is a long-term game.

We see plenty of scope for growth in the sector over the next two or three decades. In the UK investors have opportunities to structure for capital growth or tax-free income, depending upon objectives, but investment scale is a limiting factor, with the annual market worth circa £80 million of transactional activity.

Investors looking to scale up to larger positions will find opportunities across the globe where large portfolios are available, although understanding the associated risks for different countries must be considered.

Worldwide trade of sawnwood

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)