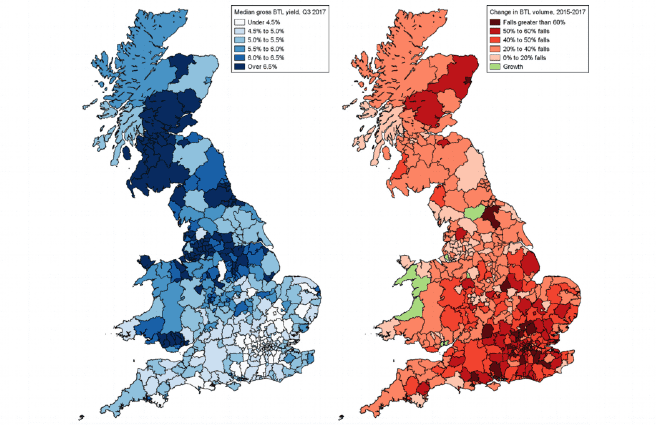

Source: Savills using UK Finance

Many of these lower yielding markets are in London. In Islington, pictured above, where gross yields average just 4.5 per cent, buy-to-let lending fell by almost three-quarters (72 per cent) over the last two years. In Richmond-upon-Thames, where yields average 3.8 per cent, lending fell 69 per cent.

In the past, it made sense to borrow (very often on an interest-only basis) against investment properties. Most buy-to-let investors did so. But now stricter rules around lending and reduced tax relief make buy-to-let borrowing look significantly less attractive, particularly in lower yielding markets. Since 2016, landlords have had to pass the same interest rate stress tests as owner occupiers. They must demonstrate they can charge enough rent to cover almost one and a half times their mortgage payments. And the amount of tax relief landlords can claim on their mortgage interest payments is shrinking: from 6 April 2020 relief will be limited to 20 per cent, increasing costs for higher-rate taxpayers.

This is just the beginning. We predict that buy to let lending will fall another 27 per cent by 2022. Those falls will likely be concentrated in the higher value, lower yielding markets of London and the South East.

These falls in buy-to-let lending could reduce the amount of stock available on the rental market. If cash investors don’t step in to buy up additional stock, restricted rental supply could drive up rental values.

Further information

Contact Savills Research

.png)

(4).jpg)

(1).jpg)

.jpg)

.png)

.jpg)

.jpg)