When the outcome of the Brexit referendum was initially announced, the industry largely immediately assumed that there was going to be a swathe of company departures from the City of London, as large financial services firms, and the professions related to them, quit the UK for continental Europe in order to retain easy access to EU markets.

Almost two years on, however, the reality is very different. The overriding tone of Brexit-related announcements from the banking sector over the last quarter has been the exact opposite. Four major banks have recently announced that their initial assessment of thousands of jobs having to relocate to within the EU has now been downgraded to hundreds.

Likewise, the latest Reuters poll of 119 firms in the City concluded that the likely total number of jobs lost or moved would be around 5,000. Reuters also analysed all the jobs being advertised by JP Morgan, Morgan Stanley, Citigroup, BAML and Goldman Sachs and concluded that together they have 1,544 vacancies to fill in the UK, and 'less than 200' in Dublin, Frankfurt and Paris combined – far fewer than the tens of thousands of jobs initially mooted in the days following the vote.

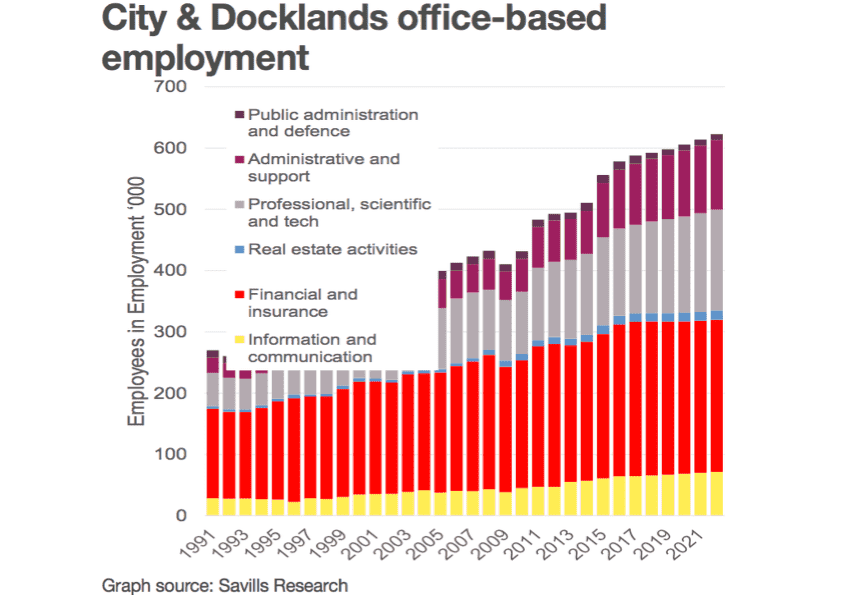

While Savills was never in the uber-bear camp on the impact of Brexit on the City, we have also now revised down our view on its likely impact on employment in the City and Docklands (see graph below). This means that even our worst case scenario implies a rise in overall employment in those locations, albeit with jobs in other industries, such as science, tech, and media (which are generally more resilient to the impact of Brexit) replacing around the 13,000 that may be lost in the finance and insurance sectors.

These 13,000 fewer jobs in traditional City industries also won’t all be down to the impact of Brexit, but to a variety of factors, including natural attrition by finance companies who have become more margin conscious post the GFC, and the replacement of some roles with AI and technology. Continuing strong growth in other business sectors will however more than compensate for this structural change, with overall Greater London office-based employment forecast to rise by 162,000 jobs between 2017 and 2022.

In fact, rather than occupiers looking to exit the City, a more pressing issue is likely to be a lack of grade A space, with – as of March – 11 per cent less grade A available compared to a year ago, and a shortage of space in particular in the 50,000 sq ft+ bracket.

(4).jpg)

(1).jpg)

.jpg)

.png)

.jpg)

.jpg)