Manchester and Salford’s hotel development pipeline has been relatively active over the last decade. Yet despite the high level of planning applications for new hotels, the actual number of new rooms delivered has been fairly restrained. However, this has changed in the last two years and as such the supply and demand of hotels in Manchester and Salford is becoming more well-balanced. There are a further 2,713 rooms due for delivery between 2018 and 2020, which would increase total hotel room supply by 20 per cent.

This year alone has seen 874 new rooms delivered. Consequently, while revenue per available room (RevPAR) increased by an above average 5.7 per cent in 2016, it grew by only 0.4 per cent in the year to September 2017 as supply increased. This puts Manchester at the lower end of the UK city rankings but it’s ultimately positive, indicating that supply of and demand for hotel rooms is broadly in balance.

Of course, the market is not without its challenges. Looking ahead, the key driver for hotel demand and revenue outside London tends to be GDP growth and although the outlook for the UK has generally been revised upwards over the last 18 months, we are still looking at a period of lower than average output growth. Hotel operators will also be challenged by further pressure on their operating margins, not least from inflation and a heavy dependence on non-domestic staff.

Yet while some European and global cities have either experienced or speculated that the emergence of alternative lodging models such as Airbnb is a challenge to hotel viability, this is less true in the UK and specifically in Manchester. Airbnb rentals in Paris account for nearly 2.5 per cent of the total residential stock but in Manchester this is just 0.4 per cent, even lower than London’s and 0.8 per cent.

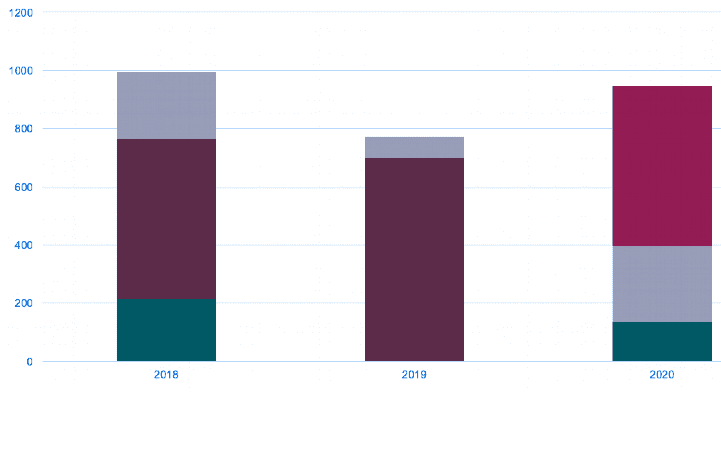

As our table below shows, the biggest gain in hotel room numbers for Manchester over the next two years will be in the four star segment and the greatest percentage increase will be in the serviced apartment market. This pipeline, combined with modest increases in demand and performance, is probably all that the city needs to satisfy demand and maintain viability for the immediate future.

.jpg)

.jpg)

.jpg)

.jpg)