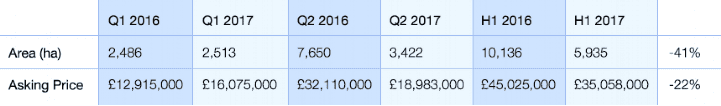

As we reach the middle of the summer we are beginning to see how the market for UK forest property will take shape this year. Although a good number of plantations have been advertised for sale, supply is down on last year (see table, below) and at the end of June supply of investment forests (excluding mixed use or amenity woodland) was back about 40 per cent.

.jpg)

The drop was less pronounced in cumulative asking price which showed a 20 per cent correction. This highlights the regional differences between forest values – it's actually very difficult comparing like for like in forestry as each property has unique characteristics affecting value.

Of course forestry, like any property asset class, has different grades or qualities that influence marketing and price. To be classed as ‘prime’ investment assets forests should typically have scale (perhaps over 200 hectares), be growing a good proportion of the higher yielding conifer species such as spruces, have, or at least have the ability to develop, good access, and be well located for a range of competing timber markets.

Matching all these criteria tends to be limited to the southern half of Scotland and in a few isolated parts of northern England and central Wales. But there are plenty of poorer quality assets in these areas too, and indeed other more remote parts where an ‘investment microclimate’ occurs, producing the odd hidden gem.

The investment market has a number of very active buyers in the prime sector but our research shows activity drops off quickly thereafter, with some secondary or unexceptional forest property having longer marketing times or put under offer without going to a closing date.

Large spruce-dominated forests in prime areas sell quickly and normally attract competing buyers, but like any form of in demand commercial property yields are very low in competitive bidding situations (sub 3 per cent) and buyers will increasingly have to expect lower returns for the best assets.

There is now some sentiment that capital values, which have seen sustained annualised growth of around 7 per cent for the past 20 years, are nearing their zenith, but that ignores the effect timber price has on forestry valuation – if timber prices continue to rise, which they are forecast to, they can continue to drag forest values up further.

We feel there is therefore still plenty scope to make good investments in the UK forestry market.

Further information

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)