There have been many conflicting reports over the past few weeks about sales volumes across the UK housing market, but official figures are far less pessimistic than many of the headlines.

HMRC figures, which record completed sales based on stamp duty receipts are perhaps the most reliable indicator of total sales, while the Council of Mortgage Lenders (CML) records tell us what type of buyer is actually in the market.

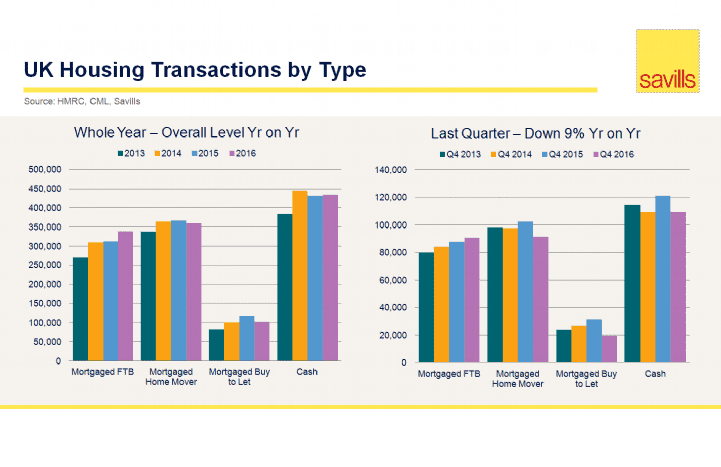

These data sets tell us that the housing market has not ground to a halt, but rather that the total number of house sales in 2016 was on a par with 2015. We saw a dip in the closing three months of last year, with volumes down 9 per cent compared with the final quarter of 2015, but compared with the same period in 2014 they were down only 2 per cent.

In the market for homes worth over £500,000, which account for about 9 per cent of all UK housing transactions, sales actually rose by 11 per cent in 2016 compared with 2015, though in the last quarter they were down by 5 per cent year on year.

Buy-to-let sales volumes dipped the most, as mortgage regulation and reduced tax benefits began to impact on the sectors appeal for investors. In this submarket, transactions were 39 per cent down year on year in the last quarter of 2016 albeit mortgaged buy to let only accounted for one in 12 transactions across 2016 as a whole. At the same time, supported by a combination of bank of mum and dad schemes such as Help to Buy.

Our forecasts are for lower transactions across the UK housing market as a whole in 2017 and 2018, though these are within the normal bands of tolerance for a weaker market, against a backdrop of economic uncertainty during the Brexit negotiations and tougher lending criteria. But as our forecasts also stated, we do not expect this to translate into price falls.

.jpg)

.jpg)

.png)

.jpg)