As Team GB celebrates one of its most successful Olympic Games and Rio passes the baton to Tokyo, we took a look at how some of the Olympic host cities have fared in the wake of challenges posed by the Global Financial Crisis.

We compared the residential markets of Rio de Janeiro to four former Olympic host cities: Sydney, Athens, Beijing and London, along with the next, future host, Tokyo.

London stands apart as the most expensive of the six, with average prices of $1,400 per sq ft (based on a blend of prime and mainstream property). Rio is the least expensive at just $130 per sq ft, more than 10 times cheaper than the 2012 host.

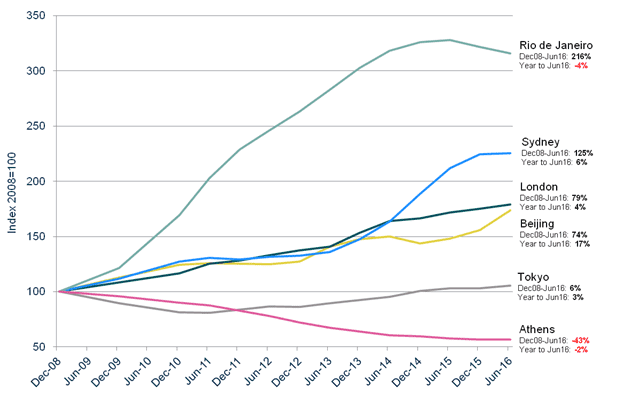

When it comes to price growth though, Rio de Janeiro leads the pack. It saw the strongest run-up until 2015 and capital values today stand some 216 per cent above 2008 levels. Domestic economic conditions have since dragged on the Rio residential market and the recent slowdown has seen in prices falls of 4 per cent in the year to June 2016.

Sydney has seen the second highest growth of the Olympic cities, buoyed by strong national and city economics but is now levelling. In Beijing, residential prices are up 74 per cent since the city hosted the Olympics in 2008, rising 17 per cent in 2016 alone. A series of stimulus policies have had a positive impact on both transaction volumes and prices in Beijing since late 2014.

Two Olympic cities stand out from the group, having failed to recover from the knockout blow delivered by the GFC. Athens, the birthplace of the games, has continued to show price falls for the last eight years. Prices here stand 43 per cent below their 2008 peak. The only positive news seems to be that the rate of decline has slowed, down 2 per cent in the year to June 2016. After years of decline, prices falls have now slowed here, down 2 per cent in Athens in the year to June 2016.

Tokyo, too, saw price falls until 2011 but, perhaps buoyed by its 2013 bid to host the 2020 Olympics price growth, subsequently totalled 31 per cent. Abenomics – the economic policies advocated by Japan's Prime Minister, Shinzō Abe, since December 2012 – has fuelled new construction and helped stimulate price growth. Looking ahead to 2020, the majority of new infrastructure will be located in the Tokyo Bay area, with the athletes’ village on the Harumi waterfront. The games are anticipated to be a catalyst for new condominium and commercial development in this traditionally overlooked area.

.jpg)

(4).jpg)

(1).jpg)

.jpg)

.png)

.jpg)

.jpg)