Source: Savills World Research / Wealth Briefing

Asia based private wealth

Top buys: Africa & North America

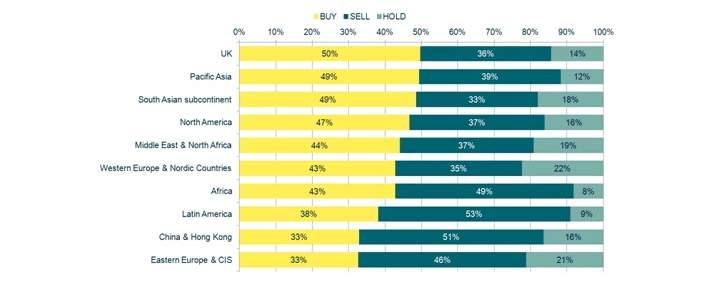

Asia-based UHNWIs and HNWIs are sending the strongest real estate purchasing signals globally, with an anticipation to buy more real estate in every global region in the next five years, apart from China and Hong Kong, which is an equal ‘buy’ and ‘hold’.

For Asia-based private investors, Africa tops the ‘buy’ list. The Chinese have been investing in African real estate to secure food production and resources for fast-growing home markets. Some 83 per cent of Asia-based wealth advisors said their clients intended to buy African real estate in the next five years. North America comes a close second, with 75 per cent of Asia-based advisors citing it as a client ‘buy’.

In the US residential markets China is now the second largest international buyer group, behind Canada. Appetite for US commercial property is growing rapidly.

North America based private wealth

Top buys: Latin America and North America

For North American UHNWIs and HNWIs, real estate investment is set to stay closer to home. In spite of economic slowdown in some Latin American economies, this region is the strongest ‘buy’, with 50 per cent of advisors indicating their clients intended to purchase here in the next five years. Mexico stands out particularly. The US market is the other major ‘buy’ for North American real estate buyers in the next five years, with 49 per cent intending to buy in their homeland.

Western European based private wealth

Top buys: UK and Western Europe and Nordics

For Western European UHNWIs and HNWIs, the home markets are the top ‘buys’, with 52 per cent of advisors citing the UK as their clients’ choice for future real estate purchase, followed by Western Europe and the Nordics, at 44 per cent. In the UK, recovery in the regions, coupled with London’s world city credentials will support growth.

Western Europeans are the only global region that cite Western Europe and the Nordics as a majority ‘buy’ market (44 per cent), suggesting local knowledge may better help navigate opportunities in a multi-speed Europe.

Global prospects

These findings suggest that the next five years will see even greater demand for global real estate from UHNWIs and HNWIs. This is likely to be focused on land and residential property. Interest in industrial units and offices is holding up despite some significant sellers but a quarter of respondents think the time is coming to sell retail.

As private investors and real estate investors and become fully allocated in core markets, a move into new sectors is the next logical step, particularly for investors seeking income returns. Regional trends suggest a preference for familiar and well-trodden markets, but with appetite for some risk in the growth markets of Africa and Latin America.

The tendency to ‘hold’ is high among all UHNWIs and HNWIs studied. Properties are typically held long term, often with the intention of passing onto the next generation. This is in contrast to institutional investors, for example, who regularly rebalance a portfolio with shorter-term performance in mind.

Further information

Visit Savills World Research

.jpg)