HNWI Real Estate Holdings

For Ultra High and High Net Worth Individuals (UHNWIs and HNWIs), the accumulation of wealth has gone hand in hand with the accumulation of land and property. The global marketplace is not just about investments in businesses, but also about having a stake in places: the locations where that investment lands. This means that the world’s wealthy create demand for investments in residences, second homes, commercial property and land.

During 2015 Savills and Wealth Briefing surveyed global wealth managers on their clients' real estate investment holdings and their intentions over the next five years. The results of the survey provided insights into the behaviour of an important segment of the world real estate capital markets, the fifth of all transactions that are private wealth. These are the clients of the private banks, family offices, independent financial advisors, trust companies and asset/wealth managers in our survey.

The findings provide an insight into the property investing habits of HNWIs. This is a group which has not been as fully studied as corporate or institutional wealth, but one that has major impact on the world property stage.

HNWI real estate holdings: direct

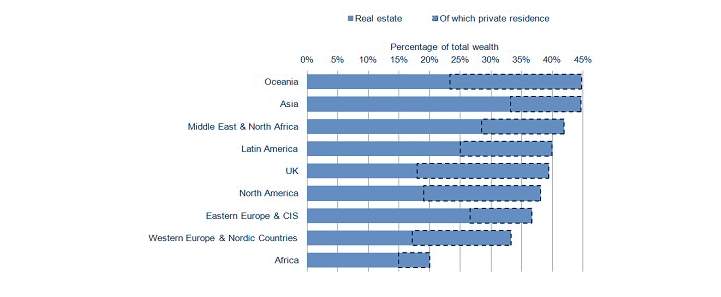

At a global level, according to our survey, the average HNWI holds 36 per cent of their wealth in direct real estate. Fourteen per cent of this is in their private residence; a further 14 per cent is held in indirect real estate (property companies, REITs and investment funds, for example).

Those with the greatest penchant for direct real estate holding (excluding private residences) come from Asia (33 per cent of total wealth), MENA (28 per cent) and Eastern Europe and CIS (27 per cent). These are regions characterised by emerging markets, and real estate in safe haven jurisdictions is viewed as a familiar, tangible asset class and store of wealth, particularly by the newly rich. In developed nations, there are more investment options available, including indirect real estate investment. As a consequence, HNWIs in North America, the UK and Western Europe all have slightly lower weightings to direct real estate (19 per cent, 18 per cent, and 17 per cent respectively).

When it comes to direct investment in private residences, the trend is reversed. Lower ticket prices in the emerging world mean that weightings here are comparatively lower. In the UK, a higher proportion of real estate wealth is held in private residences than in any other real estate investment. High ticket prices of London prime property, where many HNWIs are concentrated, contribute to this.