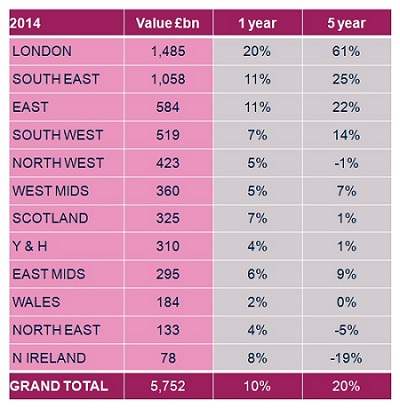

Savills latest research has found the total value of residential property across the UK now stands at £5.75 trillion, up by £543 billion in one year, and £966 billion in five years.

In London alone, residential property has reached £1.5 trillion, more than all the housing stock in Scotland, Wales, Northern Ireland and the North of England combined. London’s two wealthiest boroughs, Westminster and Kensington & Chelsea, have a higher combined value than the whole of Wales.

The value of London's housing stock has risen by 20 per cent over the past year, up by 61 per cent over the last five years, with more than double the growth of any other region in the UK. Average prices in the capital now stand at £429,000, which is £300,000 more than the average price of a property in Scotland.

(1).jpg)

.jpg)

.png)

.jpg)

.jpg)