Office occupancy rates increase worldwide in 2024

Many companies try to encourage employees to return to the office by investing in the improvement of the space available to them

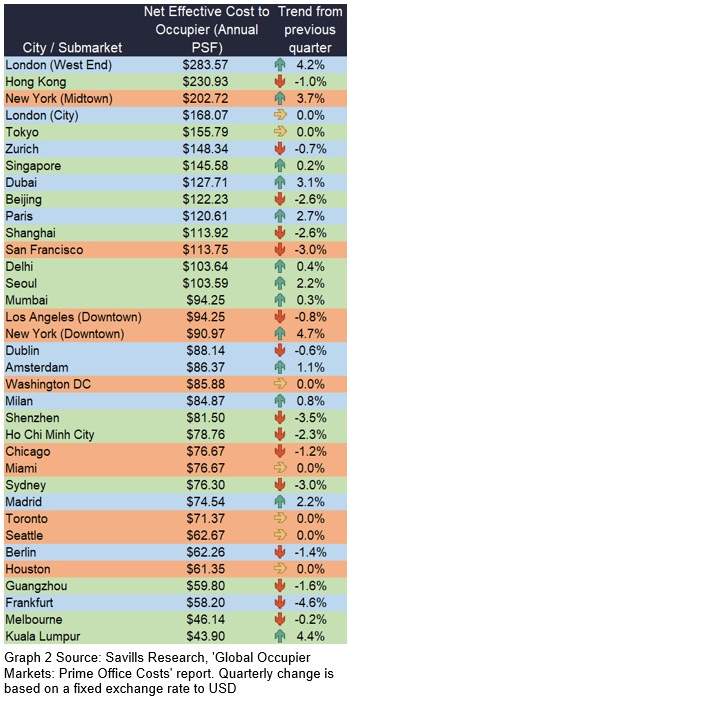

According to Savills latest Impacts study, rents for prime office space in the world´s major cities increased by 1.1 per cent last year (from the first quarter os 2023 to the first quarter of 2024), as the structural trend of demand for high-quality office space continues into 2024)

Office occupancy levels continued to rise, as many companies seek to incentivise employees to return to the office by investing in increasing the quality of the space available. Office utilisation rates continued to rise in all the main regions (graph 1), although there is still a large divide between Asia-Pacific locations, which have consistently maintained a strong office culture, and Europe and North America, where more flexible working practices have taken root.

.jpg)