Local Housing Allowance rates will increase in April, but will they cover the rents of new benefit claimants?

After a four-year freeze, the 2023 Autumn Statement confirmed that Local Housing Allowance (LHA) will increase in April 2024 to return it to the 30th percentile rent. This means that, theoretically, 30% of the market is affordable to those reliant on housing benefit. However, our analysis of over one million Zoopla asking rents in 2023 demonstrates that across Britain only 8.5% of new listings would have been affordable using the new LHA rates.

Issues of affordability are not exclusive to those reliant on LHA or the private rented sector (PRS). They impact all tenures and are a result of a shortage of supply of affordable housing to both rent and buy combined with a spike in housing demand. This emphasises the need for delivery of more homes of all tenures.

LHA is the cap on the amount of housing benefit that tenants in the PRS can receive. It is dependent on the number of bedrooms in a property and location according to Broad Rental Market Area (BRMA), an area defined by where it is reasonably expected for a household reliant on housing benefit to live.

Across Britain, LHA will increase on average by 17%, or £110 more per month, compared to when rates were last increased in April 2020 (Figure 1). According to the 2022-23 English Housing Survey (EHS), 24% (1.1 million households) of private renters received housing benefit to help with the payment of their rent. The increases will therefore improve affordability for a significant number of people. However, since rates were last set using rental data from September 2019, private rents in the UK have grown on average by 28% to September 2023, according to Zoopla.

New Zoopla rental listings do not provide a perfect representation of the whole rental market. Nevertheless, they give a good indication of current rental levels that housing benefit claimants face when looking for private rented accommodation.

Scotland has the highest proportion of affordable listings, at 14.9%, followed by England at 8.2%. Wales has the lowest proportion of listings affordable at 5.5%, although the Zoopla data for Wales gives only a small snapshot of the PRS market in the country as a whole, making it less indicative than for England and Scotland. Notably, no BRMA in Britain achieves the 30th percentile in terms of affordability, with Lincoln having the highest coverage of 24.5% of new listings.

Figure 1 LHA increases compared to rental growth*

Source: Savills using DWP, VOA, Zoopla Rental Indices – Powered by Hometrack

*LHA increases are based on yearly rents to the end of September and come into effect in the following April

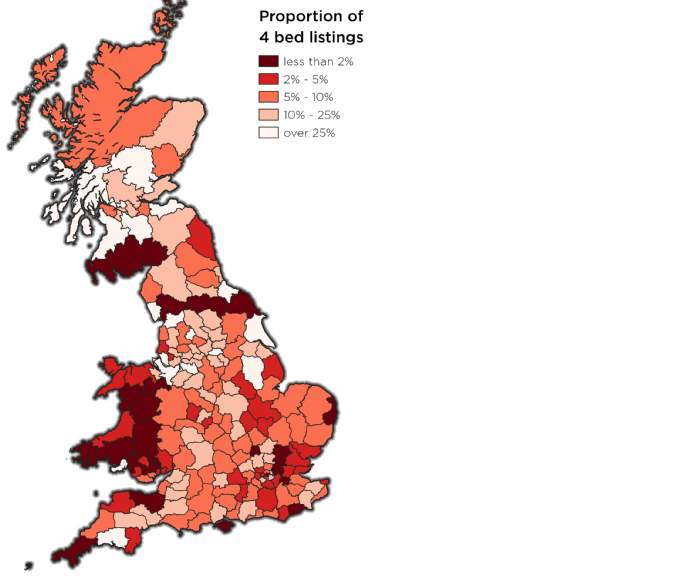

Affordability differs significantly across bedroom sizes (Figure 2). LHA rates cover more one bedroom properties (15.7%) than any other size of property, followed by four beds (9.8%). This is over double the proportion of affordable two bedroom and three bedroom listings, at 4.8% and 4.3% respectively. Yet these are often the most in-demand and suitably sized properties for households, with 59% of housing benefit claimants in the PRS having at least one dependent child according to the EHS.

The lack of affordable listings negatively affects households

Despite the LHA increase, households reliant on housing benefit face significantly reduced options in the PRS. This leads to increased competition for stock at lower price points and may keep households in living situations which no longer meet their needs.

The overall benefit cap puts further limits on the total amount claimants can receive according to household composition, location, and employment status. If the benefit cap does not also increase in line with LHA, this will further reduce affordability, especially in places such as London where high rents mean many benefit claimants are already affected by the current cap.

The situation is likely to worsen given the limited supply of private rented homes, continued high demand, as well as the inbuilt shortages of homes. There were 105,750 households living in temporary accommodation in England in 2023, according to the Department for Levelling Up, Housing and Communities. This was the highest level on record and 10.5% above the year prior. The knock-on effect is increased spending by councils on homelessness services, which in the year to March 2023 was £1.7 billion, up 9% on the previous year.

Figure 2 affordability of 1-4 bed listings on 2024 LHA

Source: Savills using DWP, VOA, Zoopla Listings data – powered by Hometrack

New supply of affordable housing to both rent and buy is desperately needed

Demand-side interventions can only go so far to address the housing crisis. Reliance on the PRS is the consequence of a smaller social housing sector. Since the 1980s affordable rented housing has shrunk from 31% to 17% of total English housing stock.

Policies which help boost supply of all tenures are now required urgently to ensure more stable housing for all, including low-income families. Research by the Joseph Rowntree Foundation and Tony Blair Institute for Global Change showed that 700,000 additional social rented homes would be needed to return social renting for low-income families to its 1979 level.

Increasing the delivery of social housing is not possible without new policy initiatives and a substantial increase in subsidy. This could be more cost effective for the taxpayer as it would cut the housing benefit bill and reduce the ballooning cost of temporary accommodation for homeless households.