Planning permissions fall further

The ongoing contraction in new homes gaining full planning consent showed no sign of abating in Q3. Only around 257,000 homes were estimated to have gained planning consent in the twelve months to September 2023, according to HBF/Glenigan data. That’s the lowest annualised figure since September 2015, and at least c. 100,000 too few to have a good chance of hitting the government’s target of 300,000 homes per annum. Even with a small upwards revision likely, the downward trajectory looks set to continue.

Delivery of new homes sees small drop

Given the poor outlook for planning permissions, and a weak sales market generally, a decline of only -4% in annual completions seems comparatively positive. Nevertheless, at 237,000 new homes built, the year to September 2023 still ranks as the lowest annualised quarter since mid-2018. It may also be a case of the worst being yet to come. Based on the current timescale of eighteen months to two years to convert a planning permission into a new home, the sharp drop in planning consents since mid-2021 would only just be beginning to really pinch.

A slew of new rules came into force over the summer, including the Building Safety Act 2023 and new Part L building regulations (introduced last year) coming into full force. The result has been a rush to formally start on site during the grace period before the new rules took effect – sending official data on starts soaring. These “paper starts” are unlikely to all become new homes any time soon, however, and other indicators like brick deliveries and purchasing indices suggest housebuilder activity remains subdued.

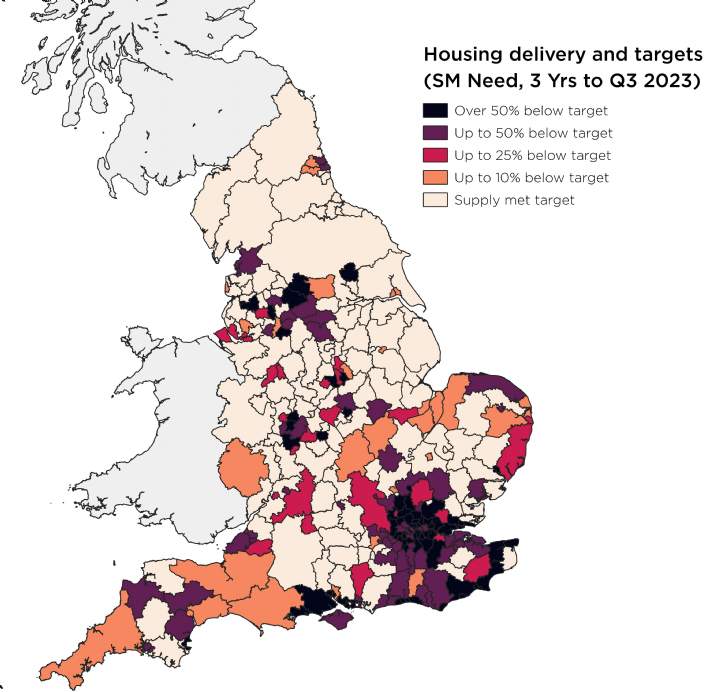

Little improvement on meeting housing need

Despite the passage of the long-awaited Levelling Up and Regeneration Bill into law, much uncertainty around planning policy remains. On nutrient neutrality, for example, the last few months have seen the government fail to amend the LURB to remove the rules, announce a stand-alone legislative measure, and then scrap that effort as well.

Given this backdrop, England is unlikely to improve the supply of new homes going forward. As Figure 1 (below) shows, 40% of Local Authorities met their housing need targets in the three years to Q3 2023. 22% missed the target by more than half.