NEW BUILD SUPPLY THREATENS TO REVERSE

The supply of new homes in England remains under pressure, with 239,300 new homes completed in the twelve months to June 2023 according to Energy Performance Certificate (EPC) data. That marks the second consecutive drop in annualised completions, although small at -2%. The rolling annual total may fall further in the coming months: at 110,600, less than half of all new homes built over the last twelve months were delivered in the first half of 2023. Excluding the pandemic, this is the lowest six month figure since 2017.

CONSENT CRUNCH CONTINUES

Around 255,000 homes gained planning consent in the twelve months to June 2023, according to HBF/Glenigan data, barely above the present level of delivery. Indeed, given a proportion of permissions are inevitably lost to attrition, roughly 30,000 more consented homes would be needed just to maintain supply. Scarcity of consents will put further downward pressure on future completions.

A key factor has been ongoing uncertainty over planning policy. The Levelling Up and Regeneration Bill, which will introduce revisions to the NPPF, has been delayed and will not return to Parliament for consideration of amendments until the Autumn. Local planning has also slowed. Over the last decade an average of twenty-seven local plans were adopted each year; halfway into 2023 only eight have been adopted, under half what would be expected.

OVERALL DELIVERY SET TO FALL IN 2023

It’s not all doom and gloom. Stronger than expected first-time buyer demand, falling inflationary pressures and interest rates likely approaching their peak have prevented further falls in activity and confidence. Nevertheless these factors must be balanced against price falls, mortgage costs remaining higher for longer and, ultimately, too few planning consents. Overall, new home completions are unlikely to exceed 225,000 homes in 2023.

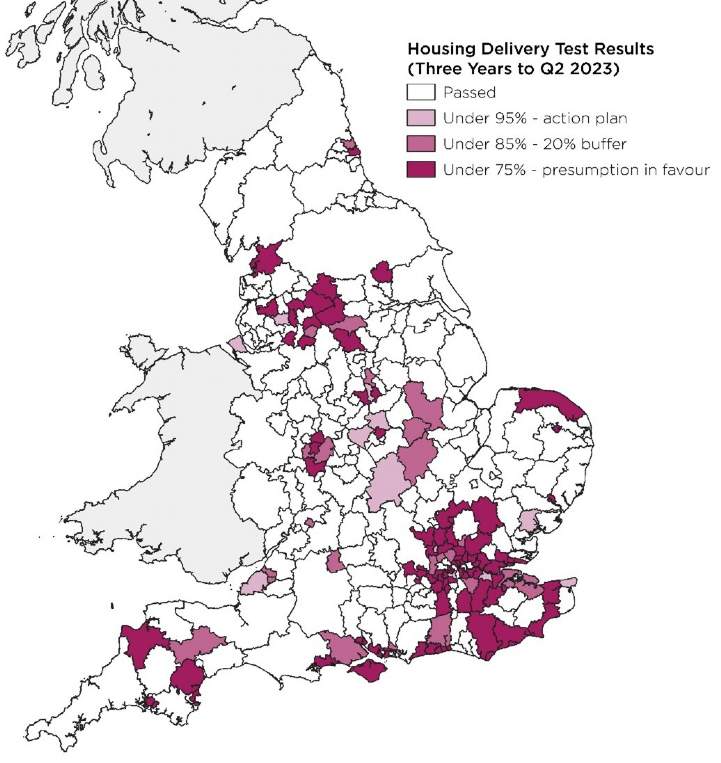

Looking ahead, the government target of 300,000 new homes per year will almost certainly be missed in the medium term. By our latest calculation of the Housing Delivery Test, 40% (122) of local authorities would fail to meet housing need, with 85 facing the presumption in favour of development.

OPERATIONAL SECTORS OFFER STABILITY

In contrast to the wider market, operational sectors such as Build to Rent (BtR) and Affordable Housing are on course to enjoy a steadier year. BtR starts are down but the rate of decline has slowed; meanwhile completions are on the rise again as the sector enjoys strong rental growth and more investment. Housing Associations’ appetite for development is more mixed, but some have retained considerable development aims, with the sector able to play a key role in providing supply in a slower market. The number of new Affordable homes looks set come in at the second-highest in eight years, with an estimated 26% rise in the number of social rent homes being built.