NEW HOMES COMPLETIONS DOWN IN Q1

After last year’s near-record number of new homes being built, the start of 2023 saw supply begin to contract. 246,700 new homes were completed in the 12 months to March 2023 according to Energy Performance Certificates (EPCs), a slight dip of 2% compared to the previous annualised quarter. Quarterly figures present a starker picture, however; Q1 saw completions decline by 20% compared to Q4. The question is now whether Q1 represents a sign of things to come or merely the worst of the downturn. Higher interest rates, build costs and the end to Help to Buy all present demand-side headwinds for the year ahead.

More positively, the housebuilding sector has thus far proven resilient, with major PLC firms achieving sales rates above expectations in Q1 2023, albeit through pinched margins and heavy use of incentive schemes.

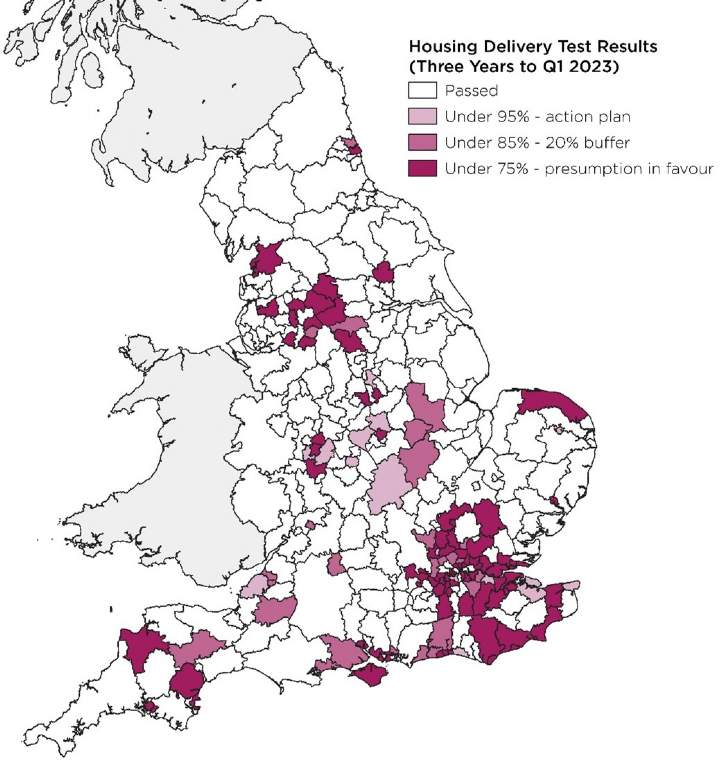

Regardless of whether delivery stabilises or declines further, the number of new homes being built remains stubbornly below what is needed. Our calculation of the Housing Delivery Test using EPC data found 190 local authorities – about three in five – would currently pass the test. By contrast, 80 would face the most severe sanction of presumption in favour of sustainable development.

PLANNING PERMISSIONS REMAIN CONSIDERABLY BELOW HOUSING NEED

The number of homes granted full planning permission is estimated to have fallen to around 255,000 in the twelve months to March 2023. Even accounting for future revision, supply is likely to be well below the 295,000 new homes a year needed according to Standard Method assessment. Five English regions are at risk of seeing fewer homes built in the future; three of those – the South East, South West, and West Midlands – already fail to meet their objectively-assessed housing need at present.

Worse, planning permissions may fall further still. Uncertainty over planning policy has contributed to a contraction in planning applications, with applications 14% lower in 2022 than the previous year according to government data. The uncertainty has also led to a slowing down in adoption of new local plans, preventing new housing allocations from being confirmed. Add in a mixed economic picture and a lack of resolution around environmental issues such as nutrient neutrality, and the number of new homes gaining planning permission is unlikely to increase in the near-term.

BUILD TO RENT ACTIVITY SLOWS BUT SECTOR SUSTAINED BY STRONG PIPELINE

The Build to Rent (BtR) sector continues to see slowing of activity from the breakneck pace of recent years. Delivery of homes has fallen considerably, with construction starts down by over a third in the twelve months to Q1 compared to last year. Nevertheless, with a record 49,500 homes under construction, future supply in the sector remains healthy.