252,500 new homes were completed in 2022, the second-highest figure since the Global Financial Crisis. The strong figures are down to the relatively high number of homes granted planning permission between 2018-20.

Delivery was also boosted by a strong finish to the year. Even allowing for the final quarter usually seeing the highest number of completions, Q4 2022’s 66,400 homes was on par with the record high seen in Q4 2019. A peak in consents in 2021 will likely sustain completions in the short-term, as existing planning permissions are build out. Starts to Q3 were also strong in 2022, according to DLUHC figures. New homes completions are therefore likely to continue at a reasonably high rate, at least for the immediate future.

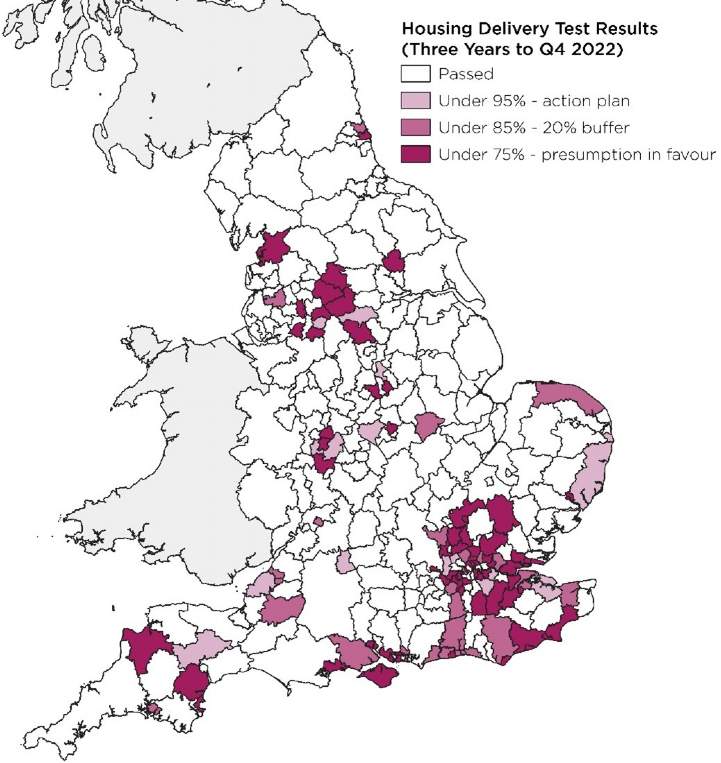

Despite strong delivery levels, however, Savills’ simulation of the Housing Delivery Test (see map below) found that less than two-thirds of local authorities (66%) would currently pass the test, with 66 facing presumption in favour of sustainable development.

LACK OF PERMISSIONS TO HIT DEVELOPMENT PIPELINE

In the medium-term, however, supply of new homes looks to be heavily constrained. The number of homes gaining consent has dropped to pre-2016 levels, with consented homes falling by nearly a third (31%) in a single quarter. Every English region saw fewer new homes gaining planning permission than in 2021. In the North and parts of the Midlands, there is still sufficient supply to meet housing need. But falling consents will place greater pressure on regions that already fail to build enough homes, such as the South East where consents were down 14% vs 2021.

CHANGING MARKET CONDITIONS ADD FURTHER CHALLENGES

Economic pressures and problems in the planning system will make ensuring enough homes are built in the right places even more challenging. Inflation, higher mortgage rates, the rising cost of living and the end of Help to Buy have all reduced demand and caused housebuilders to act more cautiously, slowing the pace of delivery. Proposed reforms and a lack of clarity on national policy are slowing the adoption of land allocations and Local Plans, limiting developers’ ability to gain planning permission for schemes. The land market is also showing signs of strain, with activity and sentiment dropping significantly in Q4, which will likely depress the number of starts on site in 2023 (read more here).

BUILD TO RENT SECTOR COOLS RAPIDLY

The Build to Rent (BtR) sector, after strong growth in recent years, saw a significant slow-down in the second half of 2022. While still high by historic standards, the number of homes starting on site has declined somewhat due to more limited investment activity in H2 2022. Completions have fallen sharply due to more challenging conditions for construction over the past two years.

2022 A BUMPER YEAR FOR NEW HOMES, BUT LOW CONSENTS AND WEAK MARKET INDICATE CHALLENGES AHEAD

NUMBER OF NEW HOMES JUST UNDER RECENT RECORD

Figure 1 Where is delivery meeting targets?

Source DLUHC Live Tables and ONS

NB This is an estimate of how the Housing Delivery Test might turn out using 2022 test thresholds (including a deduction of 122 days to account for Covid disruption), using data in the three years to Q4 2022. We have assessed housing delivery based on EPCs plus an estimate of communal dwellings based on past delivery rates. Baseline target is calculated with reference to Planning Practice Guidance, Housing Delivery Test measurement rulebook and Housing Delivery Test technical note. Figures used are based on Local Plans, household projections, standard housing need assessment and the London Plan.

Over 252,500 new homes were built in 2022, according to Energy Performance Certificate (EPC) data. Quarterly results were boosted above seasonal trends thanks to the highest number of quarterly completions since Q4 2019.

Around 265,300 new homes gained full consent in the year to Q4 2022, according to figures from Glenigan. Annual consents are 13% below the 2017-19 average, which will act as a further drag on development following increases in borrowing costs and a difficult economic environment.

The quarterly starts and completions series based on NHBC data does not capture all new homes being built, but does give a timely update on direction of travel for new build delivery.

Starts have dropped since Q2 2022, but still recorded the second-highest number of starts since December 2007. Annualised completions reached 173,200 in the year to Q3, high by historic trends.

With construction starts running ahead of completions, the pipeline of homes under construction is still currently expanding. Economic headwinds and falling planning consents, however, will likely curtail this expansion over the course of 2023.

Four regions both built enough new homes to meet housing need in the year to Q4 and granted consent for a sufficient number of future homes.

Challenges remain, however, in the South East and London. The South East fell short of housing need in 2022 and consents were 14% lower than completions, indicating future supply will be even lower.

In London, consent was granted for more homes than were delivered in 2022, suggesting scope for increases to future supply. Many planning permissions will be reworked before any homes are built, however, and consents remain about a third short of total housing need in the capital.

Sales using Help to Buy (HtB) loans continued to decrease as regional price caps bite. Apart from when the housing market was closed during the pandemic, Q3 2022 saw issuance of new loans fall to their lowest level since 2016.

HtB sales remained steady in London (which was exempted from regional price caps introduced elsewhere in Q2 2021). By contrast, the rest of England has seen new loans fall by 42% year-on-year.

With the final deadline to register for Help to Buy now passed, sales must complete by 31st March 2023. Data for the final quarters of the scheme may show a rise in the number of loans, as buyers rush to complete ahead of the deadline.

The Build to Rent (BtR) sector saw construction activity slide during 2022, albeit after a very strong 2021. Annualised starts and completions have fallen by 21% and 46% during the year to Q4.

Starts fell more in regional markets (-31%), but London saw a greater decline in completions, down 54% year-on-year. Regional completions year-on-year fell 40%.

Looking ahead, the sector has yet to fully build out previous gluts of construction starts from 2021, which should sustain completions in the medium-term even with fewer schemes starting on site.

Delivery of affordable homes are expected to fall marginally in the year to March 2023, according to the latest data from NHF, but remains in line with recent years.

The composition of affordable delivery is likely to change. Social rented homes are expected to see a 21% increase on the number of homes delivered in the year to March 2022, with more completions than in any year since 2014/15.

On the other hand, delivery of affordable rented and affordable ownership homes will likely decrease from last year. Affordable rent completions are expected to fall back to 2017/18 numbers.