Prime central London will outperform as international travel resumes.

PRIME CENTRAL LONDON

Central London’s recovery unfolds

As international travel restrictions continue to ease, the pool of buyers looking to purchase property in prime central London will also continue to rise. This is likely to have the most significant impact on the market next year, when we anticipate a strong bounce back in values.

After seven years of falling values, totalling -20%, property in the capital’s most prestigious postcodes is overdue a recovery. The start of this recovery has primarily been led by an increase in the value of houses and, as such, by locations such as Notting Hill and Holland Park. But, renewed demand for flats during the second half of 2021, from both international buyers and those looking for a pied-à-terre, suggests growth is likely to become more balanced going forward, both in terms of location and property type.

Much of this short-term growth will be compounded by the pent-up demand from those who have been unable to travel. However, over the medium and longer term, a new seam of demand will also come from the continued rise in global wealth generation. This will be fuelled by the technology and life sciences sectors and, more specifically, an increase in those considered to be ultra high net worth individuals.

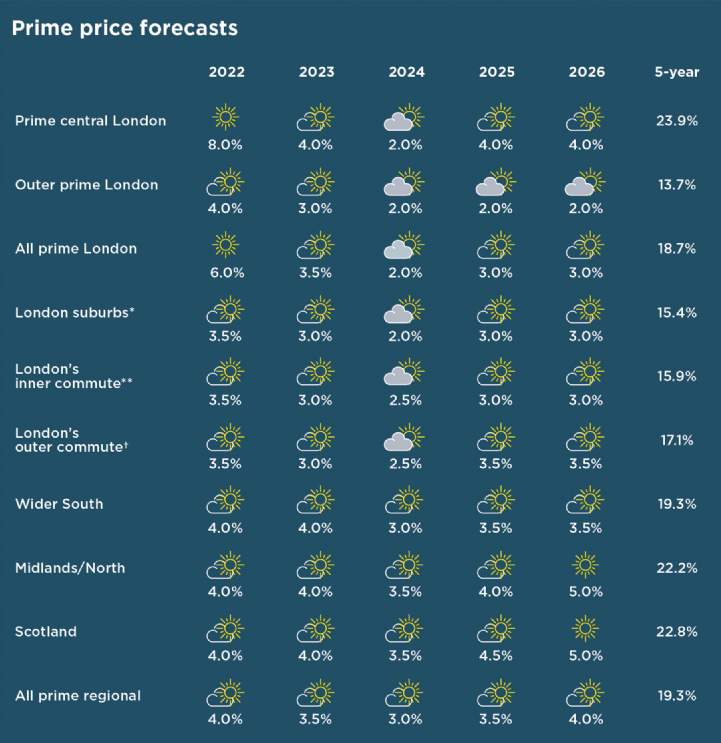

Central London’s recovery will only be tempered slightly in 2024 when uncertainty surrounding the planned general election could dampen demand. It will also be less dramatic than historically because of the underlying tax environment and the capital’s maturity as a world city. Our forecast for growth of 24% in the five years to 2026 would mean that by the end of the period, values return to their previous 2014 peak level for the first time.

OUTER PRIME LONDON

Price growth for property types evens out

Since the start of the pandemic, the more domestic markets beyond central London have primarily been driven by demand from those looking to upsize into large family homes in areas such as Chiswick and Putney.

But since social distancing measures have been relaxed, more demand from wealthy first-time buyers and young professionals has also returned. This has led to a pick-up in the rate of price growth for smaller houses and flats, particularly those in areas with good transport links to London’s business districts.

This is likely to continue in the short term, which means we will see more evenly distributed levels of price growth for different property types.

There also remains unmet demand from those looking to upsize, and this, together with a lack of suitable family housing stock, will continue to support prices.

Frances Clacy

There also remains unmet demand from those looking to upsize, and this, together with a lack of suitable family housing stock, will continue to support prices. Some displaced demand coming out of prime central London will also support stronger levels of price growth than across the wider mainstream London markets.

This means there remains capacity for sustained levels of price growth in the current low interest rate environment but, looking further ahead, the likelihood of rising interest rates will put some pressure on buyers’ spending power. There also remains the possibility of increased taxes for wealthier households and we are therefore forecasting slightly lower levels of house price growth from 2023 onwards.

PRIME REGIONAL

Flexible working sees search areas widen

The UK’s prime regional markets have continued to see strong levels of price growth during 2021 as the Covid-19 pandemic encouraged many affluent buyers to reassess where they wanted to live and what they wanted from their homes. This prompted many people to upsize or relocate, in some cases to be nearer to family and in others because of lifestyle reasons.

But these strong levels of demand mean well-priced properties have been selling quickly, especially those in the most sought-after locations with strong transport links and access to local amenities. As a result, there remains a lack of available stock across much of the market.

While some of this appetite is likely to ease slightly, longer-term changes to people’s working patterns will underpin demand from those who are able to take advantage of greater flexibility and widen their previous search areas to more suburban and rural markets further away from major employment centres.

Rising interest rates and the prospect of increased taxes will gradually squeeze the spending power of wealthier households and so we expect rates of house price growth to soften, particularly given the strong price growth we have seen throughout this year and last. In 2024, markets closest to the capital will also feel the effects of some uncertainty surrounding the planned general election.

Longer term, the price differential between prime markets in the South of England and those in Scotland, the Midlands and the North of England leaves more capacity for price growth in the latter. As such, we expect these to be the top-performing regions over the five-year period to 2026.

Prime price forecasts

Note *Within the M25 **Within a 30-minute commute †Within a one-hour commute. These forecasts apply to average prices in the second-hand market. New build values may not move at the same rate

Source Savills Research

Click here to read our UK mainstream residential property forecasts

.jpg)