We are continuing to see elevated levels of activity as supply shortages lift prices for well-presented homes. As normality returns, demand in urban locations will remain robust with longer term hybrid working patterns underpinning the market in country areas.

Faisal Choudhry

1. BUSINESS AS USUAL

The trend for more space, quality of life and value for money compared to London continues to drive prime regional markets despite the stamp duty holiday coming to an end in England and Northern Ireland. Indeed, agreed sales during September were well above normal market conditions, according to data provider TwentyCi. The number between £500,000 and £1 million was 79% higher than the average for the same month between 2017 and 2019. With little sign of a post-stampy duty holiday slowdown, agreed sales above £1 million were 121% above pre pandemic levels.

But there is a shrinking pool of stock, with the number of properties advertised for sale above £500,000 at the end of September 30% lower than the pre pandemic level. Consequently, in the three months to September, prime regional values went up by 2.0%, according to our index. That puts them 8.8% higher than a year ago, which is the highest annual growth figure in 11 years despite a tempering in the quarterly growth rate compared to earlier in the year.

2. PRICE GROWTH LED BY COASTAL AREAS AND COUNTRY HOUSE MARKET

Constrained supply has led to prime prices growing annually by 14.8% in the coastal locations of Cornwall, Devon, Dorset, Suffolk and Norfolk. Here, the market remains buoyant for well-presented properties launched at a realistic price. However, location is key, with properties situated further inland from the coast seeing relatively lower levels of price growth.

A decline in the number of available properties has also supported growth in the rarefied £2 million-plus country house market, led by the Cotswolds, where prices increased annually by 18.5%.

Meanwhile, with annual price growth of 13.9%, the exclusivity and security of the St. George's Hill and Wentworth private estates outside London is drawing demand from an increasing pool of ultra-wealthy domestic buyers.

In St George’s Hill, there were a total of 13 transactions during the first six months of 2021, the highest number recorded in the first half of any year since 2013, before the stamp duty changes.

3. BACK TO THE FUTURE

Against the backdrop of a return to offices with greater regularity, prime values in London’s commuter zone increased by 8.9% in the 12 months to September 2021.

Indeed, proximity to a place of work has moved up buyers’ list of priorities in our latest survey of buyers and sellers. Recent price growth in the three months to September 2021 was most notable in Esher (4.3%), Sunningdale (4.3%) and Harpenden (3.7%).

The survey also revealed a significant number of buyers who still dream of country living. This desire has lifted prices in the last three months in village and rural areas within London’s commuter zone, led by Reigate in Surrey where annual price growth was 11.8%.

But open spaces remain at the top of buyer priorities and this was evident in the annual price growth of properties in the Chiltern Hills Area of Outstanding Natural Beauty surrounding Henley (13.0%) and Beaconsfield (9.5%).

Beyond London’s commuter zone, regional hotspots such as Bath and Wilmslow in Cheshire have seen strong price growth, due to their value for money and favourable transport connections to London. Annual price growth here was 11.6% and 6.6% respectively.

Agents in London are also reporting an increase in the number of prime regional home owners now looking to buy a pied-à-terre in the capital to facilitate a return to the office.

4. SCOTLAND REMAINS RESILIENT

Even though Scotland did not benefit from the same level of the tax holiday offered south of the border, prime transactional activity has reached record levels. But a lack of choice is an issue here too, with 18% fewer properties advertised above £500,000 in September this year compared to the pre-pandemic average.

Constrained supply lifted prime Scottish values by 8.1% in the 12 months to September 2021. Country locations outperformed, including Perthshire (9.9%) and Fife, Stirlingshire, Lothians and the Borders, where annual growth was 11.8%.

Despite robust growth, prime values remain 17.4% below the peak of the market in 2007, signifying the capacity for further price expansion.

In Edinburgh City where prime values increased annually by 8.3%, family houses are still in very high demand. Glasgow City’s prime values went up by 6.4%, with a five-fold rise in the number of million pound transactions over the last year.

5. Looking forward

Looking ahead, with hybrid working patterns likely to continue, there is still a relatively strong core of unmet demand; the number of buyers registering with Savills in September this year was 53% higher than the figure two years ago and a net balance of +16% of respondents to our survey indicated more commitment to moving at some point in the next 24 months. But a lack of stock is having a significant effect on their ability to purchase a property. This imbalance underpins our forecast of 9.0% annual growth in prime regional values by the end of this year. Gradually rising interest rates and the prospect of increased taxes are expected to temper longer term prospects of price growth, as buyers’ spending power is gradually reduced.

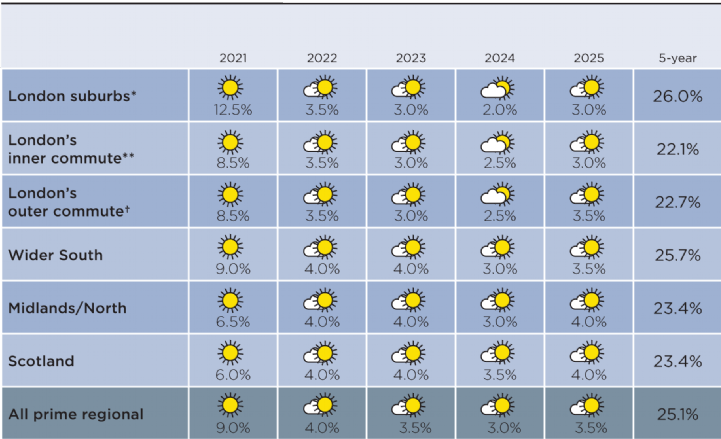

PRIME PRICE FORECASTS

Source: Savills Research

N.B. These forecasts apply to average prices in the second hand market. New Build values may not move at the same rate.

*Within the M25 **Within a 30-minute commute †Within a one-hour commute.

< View our latest Q3 2021 updates here

For more information, please contact your nearest regional office or arrange a market appraisal with one of our local experts.

.jpg)