Prime London rental prices record strongest quarter since March 2011 driven by a return to the office and the reopening of international travel.

Jessica Tomlinson

1. Prime London leads the recovery

Over the third quarter of this year, rents across prime London increased by 2.9%, the strongest quarterly growth for over 10 years.

Annual growth also returned to positive territory (1.6%) for the first time since March 2020. This provides concrete evidence that London’s prime rental market has turned a corner, with significantly increased tenant demand chasing a finite pool of available rental stock in most parts of the market.

The markets of prime central and North & East London recorded the strongest quarterly growth, fuelled by increased demand from those returning to the office, the corporate relocation market and students. Shoreditch, Clerkenwell and Westminster, in particular, stand out as areas benefitting from this change.

Elsewhere, the leafier suburbs of South West London continue to perform strongly, recording annual growth of 5.0% over the year to September 2021. Here, the trends we have seen over the past year have continued to play out, with continued robust demand for larger family homes in areas such as Wandsworth and Wimbledon.

Over the course of the pandemic rental values of flats were most severely affected by a shift in tenant priorities. But over the third quarter of this year they too have started to recover.

With more potential for a bounce-back, the quarterly rental value growth of prime London flats was greater than houses for the first time since December 2019 (+3.2% v +2.5%). Nonetheless, at this stage, houses continue to show the highest levels of annual growth.

Furthermore, with more tenant demand for a pied-à-terre – that was particularly scarce during the pandemic – one bedroom properties have seen rents bounce by 4.6% over the three months to September 2021. Similarly, rental values of properties with no outside space are also starting to recover, with growth of 3.5% over the past three-months, though in part this is due to a shortage of stock, which is causing tenants to compromise on their wish lists in order to secure a tenancy.

As a result of the significant uptick in demand across all property types and locations, nearly all London agents are now reporting a lack of stock (94%) – with almost three-quarters (72%) of agents stating that the shortage is significant. Given this sharp U-turn in the balance of supply and demand, 100% of our London agents reported seeing competitive bidding over the past three months.

In terms of applicants per property, across London in August this year there were 6.3 applicants per available property, significantly higher than August 2020 and the 2019 average of 3.2 applicants per property.

4. Stock shortages continue in the commuter belt

Rents across the prime commuter belt increased by a hefty 6.8% over the year to September 2021, despite quarterly growth slowing slightly to 1.4%.

Locations slightly further from London experienced the strongest quarterly growth, with Henley and Windsor particular hotspots. However, locations with a shorter commute time, including Sevenoaks and Tunbridge Wells, continue to show slightly higher levels of annual growth.

The easing of social distancing measures and the return to the office has meant some tenants have reassessed their requirements, restoring the importance of amenities and transport links. That has meant rents in the cities of Oxford, Cambridge and Winchester have increased by 8.0% in the year to September 2021.

Much as we have seen over the course of the last 18 months, demand in the commuter zone continues to come from a variety of sources, with many still searching for more space. And this demand has quickly depleted the levels of available stock. Over the past three months, 94% of agents in the commuter belt reported stock levels had continued to reduce. This severe lack of stock is expected continue to underpin rental growth in the short term.

5. Looking Ahead

With tenant demand now returning and a surfeit of rental stock having turned to a shortage, we expect to see an even more sustained return to rental growth across prime London for the remainder of this year and into 2022. The pace at which the balance between demand and supply has changed is likely to mean tenants will need to be flexible around location and willing to compromise on a properties attributes to secure a rental in the short term, though this will gradually ease as the market normalises.

Outside of the capital we are forecasting 2021 to be the standout year for growth, with the rate of growth easing back considerably in 2022. However we do expect to see continued demand from a group of tenants who adopt a hybrid working pattern, who are able to forgo proximity to their workplace in return for a private garden and more space to work from home.

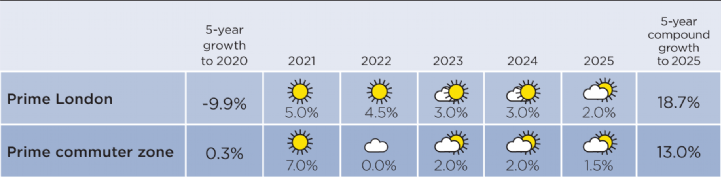

Prime rental forecasts

Source: Savills Research

Note These forecasts apply to average rents in the second-hand market. New build rental values may not move at the same rate.

< View our latest Q3 2021 updates here.

For more information, please contact your nearest Lettings office or arrange a market appraisal with one of our local experts.

.jpg)