As social distancing and travel restrictions continue to ease, lifestyle priorities and desired property types are shifting as domestic and international buyers alike flock back to the city to be in the heart of the action.

Frances Clacy

1. Central London’s recovery continues

The easing of social distancing measures and the subsequent return to the capital has meant prices in prime central London have increased by 1.4% on an annual basis, having grown by 0.7% in Q3, and are now rising at their strongest pace since September 2014.

This more sustained growth confirms our view that central London values have bottomed out and its recovery has begun, after seven consecutive years of falls. This recovery is being led by larger homes with gardens, which means the markets of Notting Hill, Bayswater and Holland Park have been the top performers over the past year, with all seeing growth of more than 2%.

However, a gradual increase in international buyers and more office workers returning to the capital also means flat values in prime central London have risen by 0.6% over the past year –the first annual growth recorded since the 2014 peak.

On the ground, an increasing number of buyers who bought in the country during the past 18 months are now looking for a pied-à-terre in London for mid-week use.

There has also been a pick up in the rates of growth across North and East London, particularly in Clerkenwell and Wapping, which both offer easy access to two of London’s main business districts: the City and Canary Wharf.

These areas also continue to be popular with wealthy first time buyers and young professionals looking for more value. Indeed, these are the buyers who are most likely to be coming back into London more regularly for work.

This return of employees has also caused a shift in buyer priorities. Proximity to a tube or train station now ranks top of buyers’ wish lists, whereas proximity to a park or open green space ranked top in June. The number of people who saw proximity to their place of work as a top priority has also increased from just 9.0% to 15%.

The value of London’s largest properties benefited significantly from subsequent lockdowns as prime buyers sought more space. This also led many to look to outer prime London areas where larger properties are more prevalent and there’s more value on offer than in central London.

Here, the value of prime houses with six or more bedrooms have increased by 7.8% during the past year, while values of five-bedroom properties rose by 6.2%. Homes with gardens also remain the top performers, those with a large garden increased in value by 1.9% during the 3 months to September, far higher than the 0.3% seen for those with no outside space. This is partly because there remains a distinct lack of homes of this type on the market so competition for those that are available has continued to push prices up.

This growth has been strongest in the family hotspots of South West and West London including East Sheen, Chiswick and Richmond. These areas offer many of the lifestyle aspects buyers have been searching for over the past year, particularly proximity to parks or commons and more of a community feel whilst retaining strong connectivity to central London.

4. Prime central London poised for meaningful recovery

Activity in the prime central London market has been supported by demand from domestic buyers and London-based non-doms who have focused their attention on homes with outside space during subsequent lockdowns over the past 18 months.

However, as travel restrictions continue to ease we expect to see pent-up demand from international buyers to fully flow back into the market. This will also be supplemented by increased demand from high-earning professionals as they return to work in offices more regularly.

As prices still remain good value in a historical context – 19.8% below their 2014 peak – we expect to see buyers take advantage of this window of opportunity leading to more significant levels of price growth (+8.0%) in 2022.

The prospects for global wealth generation, fuelled in particular by growth in the technology and life sciences sectors, gives us confidence for prime central London’s medium and long-term outlook.

5. Sustained growth in outer prime London

The more domestic areas beyond central London have been driven by demand for large houses but looking ahead we anticipate there will be increasing demand from a wider range of buyers for a wider range of property types, now that social distancing measures have been relaxed.

Here, there remains capacity for a continuation of the current levels of price growth given the low interest rate environment and continued supply-demand imbalance.

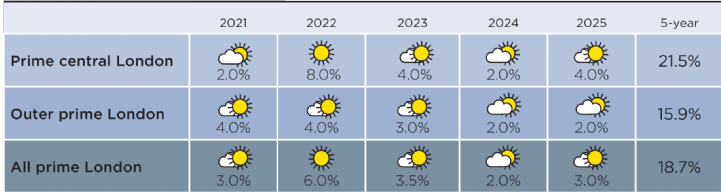

PRIME PRICE FORECASTS

Source: Savills Research

Note These forecasts apply to average prices in the second-hand market. New build values may not move at the same rate.

< View our latest Q3 2021 updates here.

For more information, please contact your nearest London office or arrange a market appraisal with one of our local experts.