Demand continues to be dominated by domestic buyers and resident non-doms looking for more space. That has meant quite wide variation in the performance of different property types and different locations over the period since the housing market reopened after the first lockdown.

Lucian Cook

1. The star performers

Very large family houses in West and South West London continued to be the star performers of the prime London housing market in the second quarter of 2021. Whereas prices of all prime London properties rose by 0.9% in the period from March to June to deliver modest average annual house price growth of 1.7%, properties of six or more bedrooms in these two locations have risen by 9.0% and 8.2% respectively over the past 12 months.

Fuelled by price growth of 1.8% and 2.1% in the last quarter, annual price growth in South West and West London has reached 4.7% and 3.5% respectively. This has been driven by demand for family housing, particularly in the markets of Putney, Richmond, Wandsworth and Chiswick.

Across these two submarkets the value of prime family houses has risen by 6.0% in the past year with the largest homes with plenty of outside space leading the way. Meanwhile, demand for flats has been somewhat more muted; meaning growth of just 1.2% for properties that have largely missed out on the so-called ‘race for space’.

This growth across prime London property is reflective of a market dominated by domestic buyers and resident non-doms looking for more space both inside and outside the home, as the experience of the pandemic and the restrictions on international travel continue to shape the demand for prime homes across the capital.

As a consequence, there is a significant variation in the performance of different locations and property types across the prime London housing market, with a clear distinction between flats and houses in all submarkets.

In central London, relatively robust housing market activity is yet to translate into meaningful price growth. Here prices only rose by 0.2% in the quarter. However, following growth of 0.4% in the previous quarter, this has been enough to give the first annual price growth since the third quarter of 2014 (albeit just 0.5%).

The ongoing delay in the much-anticipated price recovery in this submarket undoubtedly reflects continued restrictions on international travel. In particular, it continues to hold back recovery in areas historically favoured by international buyers such as Belgravia, Knightsbridge and Mayfair.

Instead, the likes of Notting Hill, Bayswater and Holland Park have captured the strongest levels of demand, given their appeal to those long-term residents in the UK who are looking for a family home.

4. A softening in some markets

With the markets of North West London, including St John’s Wood, Hampstead and Primrose Hill, sitting somewhere between these two, only the prime markets of North and East London continued to see prices soften (down by -0.3% in the quarter and -1.2% in the past year). Here the exceptions have been the established and emerging family home hotspots of Islington and Victoria Park.

5. Mind the gap: a mismatch in price expectations

Headlines of double-digit price growth of mainstream house prices have undoubtedly contributed to a widening gap between buyer and seller expectations on pricing over the past quarter.

Indeed over two-thirds of agents operating in London have reported this issue, as sellers’ expectations of the value of their home have risen. This has even been the case in central London; based on expectations of an impending recovery in prices rather than anything that has occurred to date.

6. Looking forward

While the strongest activity and price growth has been seen in the prime regional and country house markets, we expect to see a greater focus on London in the second half of 2021 as the vaccination programme continues and social distancing is further relaxed.

Though we expect some of the intensity in the family house market to ease now that the stamp duty holiday has been pared back to the first £250,000 of a property’s purchase price, our recent client survey indicates that there remains a core of unmet demand looking to move over the remainder of the year. That underlying demand for family houses is likely to be supplemented by increased demand for a wider range of property types, as London continues to regain its buzz and the workforce gradually returns to the office even if on a part-time basis in some circumstances.

In the more domestic parts of the market, the ongoing low-interest rate environment is expected to underpin current price levels, but it is unlikely to support further significant price growth. As such, sellers will need to keep their price expectations in check.

A more meaningful recovery of prices in central London is dependent on the restoration of international travel, whose timing is difficult to predict in the current environment. However, we remain of the opinion that this market looks good value in both a historical and international context and that the continued strength of global wealth generation will underpin price growth in the medium term.

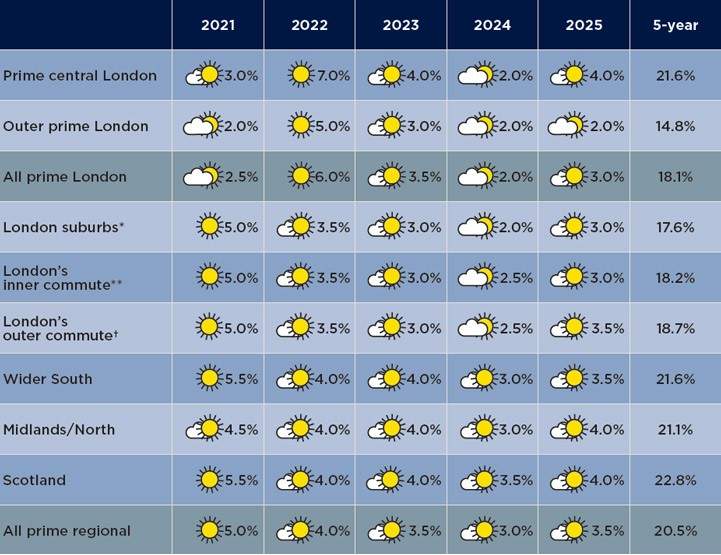

PRIME PRICE FORECASTS

Source: Savills Research

N.B. These forecasts apply to average prices in the second hand market. New Build values may not move at the same rate.

*Within the M25 **Within a 30-minute commute †Within a one-hour commute.

< View our latest Q2 2021 updates here.

For more information, please contact your nearest London office or arrange a market appraisal with one of our local experts.