Price growth has reached record levels, driven by the desire for larger homes in both urban and surrounding areas. As supply and demand gradually becomes more balanced, accurate pricing from the offset will remain important to secure a sale.

Faisal Choudhry

1. The heat is on

As we enter the traditional summer holiday period, the sun is shining across the UK’s prime regional markets. Four consecutive quarters of robust performance led to year-on-year price growth of 8.5% during the second quarter of 2021. This was the highest annual figure since September 2010.

Buyers continue to seek homes that offer more space due to the experience of Covid-19 and ensuing lockdowns. This, together with a lack of available stock, has generally resulted in a strong seller’s market.

With well-priced properties often selling almost as quickly as they become available in the most sought-after markets, the result has been competitive bidding, strong premiums and, ultimately, price growth. This has been further compounded by a reluctance among some people to bring their property to the market, not only while the risks of Covid-19 were high, but also because of the little choice in what they can buy.

As a consequence of this exceptional demand, the number of net sales agreed between £500,000 and £1 million in the market outside London was +83% higher than the average from 2017 to 2019 in the second quarter, according to data provider TwentyCi. Above £1 million they were more than double (+109%), fuelled by strong demand in April and May in particular, as people sought to beat the June stamp duty holiday deadline in England.

2. Large country houses remain the league leaders

The standout performers were the ultimate lifestyle and second home locations. These include properties in the £2 million-plus country house market. After many years of underperforming the wider prime regional markets, this rarefied segment saw annual growth of 12.9%, its strongest performance since 2007. Scotland (where the -33% price gap compared to the 2007 peak acts as an additional driver), the Cotswolds and the South West of England led this market. The Cotswolds in particular has seen demand from London buyers, who have been attracted to areas around Stow-on-the-Wold, Chipping Norton and Burford.

Some of the strongest performing markets this year have been the private estates dotted around the fringes of London. Of these, St George’s Hill and Wentworth remain the most exclusive and highly valued. Here, annual growth is sitting at 11.4%, following a flurry of activity driven by domestic buyers.

3. Coastal hotspots making waves

Demand from lifestyle relocators, downsizers and London buyers looking for a bolthole to escape city life has strengthened the coastal hotspots of Norfolk, Suffolk, Dorset, Devon and Cornwall. Here, a limited supply of suitable properties has fuelled annual price growth of 14.6%.

4. Pursuit of space continues to boost village and rural areas

The search for more inside and outside space continues to support village and rural areas, where annual price growth was 8.7% during the second quarter of 2021. The top-performing locations in recent months have included areas within an hour’s commute of London, including South Oxfordshire (which remains the epicentre of a recent million pound plus sales resurgence), Cambridgeshire, Essex, Sussex, Hampshire and Kent. Meanwhile, value for money has also lifted prices in Shropshire, Staffordshire and country locations around Edinburgh.

5. Appeal of urban living influences buyer choices

But not everyone wants a country life. For some, the urban vibe and associated amenities are more important. Equally driven by the experience of the pandemic, towns and cities are seeing strong demand from local buyers who want to be close to family, their roots and support networks. In city areas, demand for well-presented properties led to an annual price rise of 14.0% in York, 12.8% in Winchester and 8.6% in Glasgow. Here, demand for high-quality family homes that offer garden space remains strong. But it is still a buyer’s market for flats and properties that offer limited private outdoor space. Elsewhere, demand from London buyers has led to significant growth in suburban locations, where prices increased annually by 16.1% in Weybridge, 12.8% in Loughton and 10.6% in Northwood.

6. Looking forward

According to our recent survey of buyers and sellers, the commitment to moving home over the coming six and 12 months remains firm. Whilst this tells us that demand will remain strong, it also means more stock is expected to come to the market as social distancing measures are lifted. As stock constraints gradually ease, the rate of price growth is expected to soften, particularly given the tapering of the stamp duty holiday in England that is expected to take some of the urgency out of the market, though the prime markets will be less affected. The realignment of buyer and seller expectations will therefore be vital in order to maintain market momentum. That said, good quality and appropriately priced properties, particularly in desirable hotspots, will continue to receive competitive bids and interest from local and London buyers, and also overseas purchasers as international travel restrictions begin to be eased.

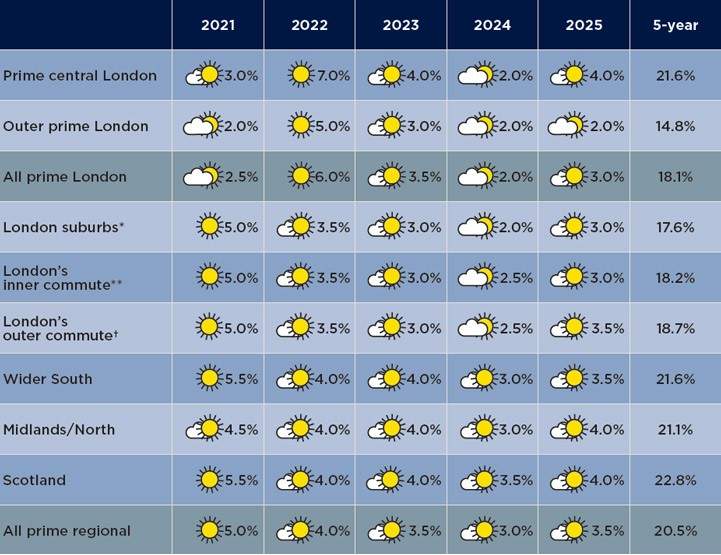

PRIME PRICE FORECASTS

Source: Savills Research

N.B. These forecasts apply to average prices in the second hand market. New Build values may not move at the same rate.

*Within the M25 **Within a 30-minute commute †Within a one-hour commute.

< View our latest Q2 2021 updates here

For more information, please contact your nearest regional office or arrange a market appraisal with one of our local experts.