It’s no longer just a story of the search for village or rural idyll that dominated 2020. This third lockdown has made some people more aware of what they’re missing and there is a real sense of urban revival.

Frances Clacy

1. Market shows highest quarterly rise since 2010

The momentum seen across the prime regional markets of the UK last year has continued so far in 2021. Values increased by an average of 2.2% in the first three months of the year, the highest quarterly increase since March 2010, and by 5.1% annually, the highest since September 2014 before the stamp duty overhaul.

Activity has also remained strong during the first quarter, with agreed sales of property worth £1m or more increasing by 93% when compared to the average for the same periods in 2017-2019. But one of the biggest issues now facing the prime markets is a lack of available stock needed to meet the continued demand.

2. Back to work planning boosts demand for prime towns and cities

While the country house revival also shows no signs of slowing, there has been renewed demand from buyers planning for their 'new normal', which has driven up values in prime regional towns and cities. Here, prime prices increased by an average of 2.3% in the first three months of this year, higher than the 2.1% seen for villages and rural locations.

In many cases, the third national lockdown has made people more aware of what they’re missing, and lots of buyers are now looking to somewhere a bit more vibrant with plenty to offer once social distancing measures begin to be relaxed. Top-performing cities include Winchester, Oxford and Bath, where prime values increased by 4.0%, 3.7% and 3.2% respectively during the first quarter of 2021.

A desire to relocate has also been prompted by a year spent apart from relatives. Proximity to family was named in the top two priorities by 48% of respondents to our recent buyer and seller survey, up from 39% a year ago. As such, some have decided to return to their home towns or cities, a trend that has been reported by our offices in Edinburgh and York, where values increased across both by 2.6% over the past three months.

3. Country houses are the star performers

Lifestyle choices continue to drive the more discretionary markets. Country houses priced at £2m+ remain the top performers, with 2.9% growth quarterly and 8.8% annually, the highest figure for over a decade. Despite this recent growth, the value on offer here (values remain 11% below their previous 2007 peak) acts as an additional driver, particularly for those looking for more space. This trend is likely to continue in the short term, at least, as demand continues to outstrip supply of the best properties.

4. Prices continue to rise across coastal markets

Strong demand from lifestyle relocators, second home buyers and local movers has seen price rises continue across coastal areas, with prime prices now up 6.8% annually. In particular, Devon and Suffolk have been the top performers over this period, as both are reasonably accessible for those from London.

5. Outlook for prices and buyer activity in prime regional sales

Looking forward, lifestyle drivers and the search for more space is likely to continue throughout much of 2021, particularly as the prolonged experience of lockdown will drive more people to upsize and, in some cases, relocate to be nearer to family.

While the value gap on offer between towns and cities and neighbouring village and rural markets will continue to support prices in the latter, renewed demand for urban areas suggests prices here will also continue to rise.

A net balance of +23% and +25% of our survey respondents said the progress of the vaccine rollout had increased their commitment to moving over the next year and the next two years respectively. So, while the stamp duty holiday extension looks set to provide a short-term boost, particularly in the market up to £1m, the rollout of the vaccine, coupled with pent-up demand from those who have put moves on hold during lockdown, will sustain demand over this year and beyond.

Longer term, the possibility of tax rises and political uncertainty are likely to dictate price movements, as this could impact on the spending power of those looking to buy in the prime markets.

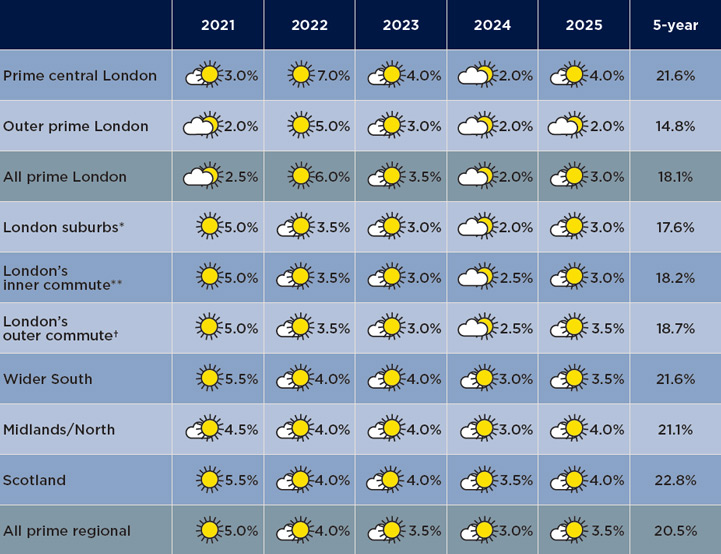

Prime Price forecasts

Source: Savills Research | Notes: *Within the M25 **Within a 30-minute commute †Within a one-hour commute. These forecasts apply to average prices in the second hand market. New build values may not move at the same rate

< View our latest Q1 2021 updates here.

For more information, please contact your nearest country office or arrange a market appraisal with one of our local experts.