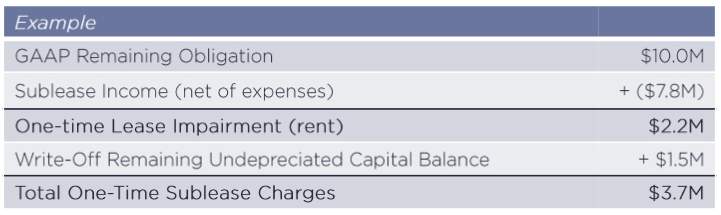

According to the U.S. and IFRS GAAP*, any projected loss from a sublease needs to be booked as one-time up-front impairment. The existing P&L rent (which is net of all inducements such as free rent and tenant improvement allowances) is offset by the sublease income (and all up-front expenses) in order to calculate the amount to be impaired. Furthermore, the remaining undepreciated balance associated with the facility or leasehold improvements is taken as a one-time write-off.

The above calculations, impairments and write-down are booked at the time there is relative certainty that the space will never be reoccupied for future use by the Tenant. Tenants do have some flexibility in determining when that certainty is known as some have shown a desire to take the one-time charges during a particular fiscal quarter or year to clear P&L expense and/or book losses prior to the start of a fresh reporting period.

Lastly, once a space is abandoned and written down on the books, the Tenant is not permitted to utilize the facility in any manner for its own operations, storage, etc.

* U.S. GAAP ASC 842; IFRS 76

The statements above are meant as a general guide to understanding the accounting procedures discussed and are not meant to be used for reporting purposes. All accounting procedures should be discussed and fully understood with a certified public accounting firm. Savills makes no warranty to the validity of the statements above and does not claim to provide certified public accounting, audit or tax services recognized by the United States or any other Jurisdiction.