COVID-19 Accelerates Change in Law Firm Office Space Strategy

Serving as national advisors on hundreds of law firm office real estate transactions each year, the Savills Legal Tenant Practice Group (LTPG) has a front-row seat to nascent trends in the legal sector. During this period of accelerated change brought on by COVID-19, we have had a firsthand opportunity to observe the effects of the pandemic on law firm strategic planning efforts.

While each law firm is unique, we have sensed patterns in law firm internal planning efforts since March of this year. Initially, law firms were scrambling to send people home, performing real-time assessments of their leases (specifically their force majeure clauses), and questioning their obligation to pay for space they were unable to utilize. More recently, we have observed conversations turn to “how to do more with less,” most specifically whether there are cost saving opportunities to be had in veering away from the traditional “one attorney = one office” formula for office space design.

Executive management in many law firms has long been frustrated by seeing attorney offices sit empty as attorneys travel, visit clients, or work outside the office. Before COVID-19, many firms were asking themselves if there might be a way to break the traditional paradigm, save money on real estate, and still keep top talent productive and happy. Some firms had experimented with new ways of working, and a select few had moved toward at least a partial implementation of day-officing, also known in the industry as hoteling, agile, or remote working (we aggregate these other terms collectively as “dayofficing,” meaning an attorney or staff member works in a location not permanently assigned to them). The advent of COVID-19, which has often been referred to as “the great global experiment in working from home,” has greatly accelerated this trend, and exposed it to a broader number of firms interested in exploring the concept.

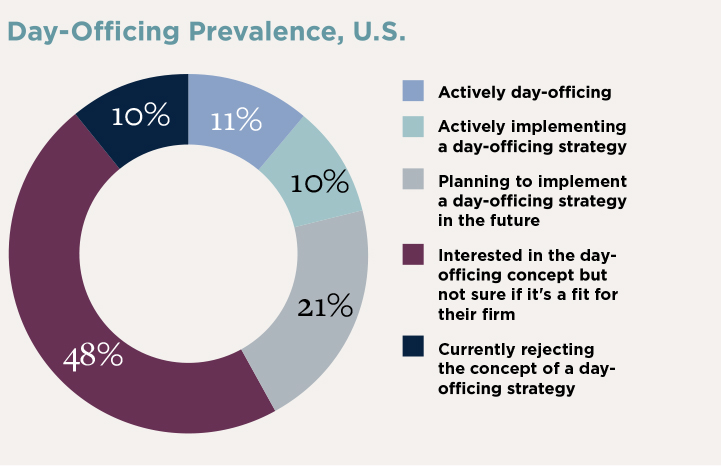

We observe that conversations about the idea of day-officing and its proper implementation dominate strategic planning efforts in many firms today. Much of what we hear, however, understandably amounts to speculation and questioning, as only a minority of firms are engaged in the real estate process or constructing space during COVID-19.

As these conversations unfold, we are often asked by our clients for benchmarking data to help them make sense of this idea, and to understand how it is playing out in the legal sector more broadly. In an effort to help quantify these conversations, we tapped the LTPG professionals within our firm and asked them to anonymously categorize the strategic planning efforts they witness unfolding in law firms they advise. In total, our advisors’ responses cover 200+ law firms, spanning every major market nationwide.