After Covid-19, Movida-20?

A V-shaped recovery would allow household spending to recover almost to pre-pandemic levels by the end of the year. This would be an extremely welcome outcome, since household spending accounts for more than half of France’s GDP. Consumers have seen their savings decimated since the lockdown began, but under this scenario the pain would be fleeting. INSEE estimates that household spending was 35% lower than normal during the last week of March, with textiles and clothing the hardest hit (losing between 90% and 100% of their share), followed by manufactured goods (60%). Hotels, restaurants and leisure businesses have been left spinning their wheels. On a more positive note, people were spending more on food products (up 6%) as households rushed to stock up on essentials and restaurant goers had no choice but to fend for themselves.

It is even possible that, as we move into summer and the lockdown eases, consumers will compensate for this spell of enforced frugality and tills will start ringing again. Freedom, release... We could even see a sort of mini-Movida, a phenomenon reminiscent of the cultural and economic resurgence that blossomed in 1980s Spain, when the lead weight of Francoism was lifted. Could Covid-19 make way for Movida-20? Hoteliers, restaurateurs and the entire leisure sector will be hoping so.

Still, anyone under any false illusions that the rebound will completely make up for lost time will be sorely disappointed. Some of the turnover that has been lost will be lost forever, especially in the increasingly likely event that the exit from the lockdown progresses in stages, with some restrictions on movement remaining, at least at the international level. It is telling, for example, that air travel experts do not expect “normality” to resume before 2021, or even 2022. The open world of the pre-pandemic age may not return for quite some time.

It would therefore seem unwise to assume that deep-pocketed tourists from Asia, the Persian Gulf and North America will immediately flock back to European shores. If a recovery is on the cards, it will be led primarily by domestic travel, potentially followed by our European neighbours.

The French investment market at the end of Q1 2020:

Winter sunshine

The French market began 2020 with a spring in its step, following the solid path laid by an excellent 2019.

The volume of investment in commercial property, up 46%, indicated that both domestic and international investors were still being drawn in by the enticing opportunities to be found in France. While yields remain at a historic low, investors are still enjoying attractive returns. All in all, it was a bright and sunny winter for the French market. Then came the storm... Winter had barely ended when an unforeseen and unforeseeable event threw everything into disarray: a pandemic that sparked a global crisis.

Investment volumes: Grand finale

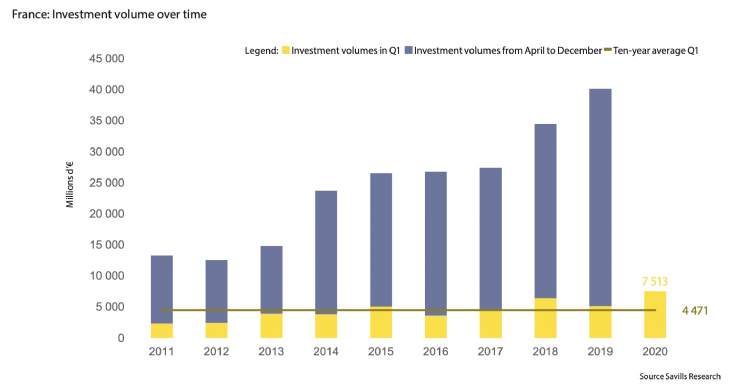

The first quarter of 2020 was one for the record books: with a total investment volume of over €7,500 million, it was the strongest start to a year ever seen in the French market. Compared with Q1 2019, it represented a leap of 46% and with the ten-year average, a 68% gain.

This ebullient performance entrenched France’s third-place position in the European rankings, outdone only by Germany and the UK, head-to- head on a little over €16,000 million each, up 55% and 30% respectively.

In the 12 months to the end of Q1 2020, the French market attracted investment of almost €42,000 million – an unprecedented performance.

Sadly, those sunlit days won’t be returning any time soon. In all likelihood, this quarter will go down in memory as the dazzling finale to a spectacular run of investor confidence in the French market over the last few years. Pummelled by the fall-out from the Covid-19 pandemic, activity began to slow in mid-March, and it seems inevitable that the gloom will only deepen in the coming months.

Origin of funds invested: A highly coveted market

As was already evident by summer 2019, the French market was powering ahead in thanks to new growth drivers that gave some extra kick to an already well-fuelled engine. Most notably, domestic investors made a resounding come-back. After slinking away in mid-2019, their market share diluted in a torrent of international mega-deals (including some staggering acquisitions by South Korean funds), by the end of the year French investors had reclaimed their majority status. This resurgence was largely attributable to record savings inflows. These remained the primary source of funds in Q1 2020, accounting for 54% of investment in the French market between January and March.

Why this sudden rebound? There were two factors at play here: a more assertive, competitive stance among domestic investors, and a more diversified positioning than many international players, with a keener interest in alternative properties beyond the traditional Parisian office market. Accordingly, Q1 saw the fruition of some major acquisitions on the part of French actors, including 33,400 sqm in the Aquarel development in Issy-les-Moulineaux, 30,000 sqm in the Parallèle building in Courbevoie, 27,300 sqm in the Valmy building in Montreuil and 10,600 sqm at 50 Anjou in Paris’s CBD. That’s before we mention the sale of the CIFA centre in Aubervilliers (29,600 sqm of wholesale space) or the Lugdunum building in Lyon (21,200 sqm of offices).

This surge has given further impetus to a market that has been riding high since Q2 2019 thanks to renewed international interest in French real estate. A global context of political instability, volatile trading conditions and uncertainties in the money markets have all worked to France’s advantage. Amid these concerns, real estate – and particularly French real estate – has started to look like a very tempting opportunity. The appeal of the French property market is largely attributable to its financial resilience, the quality and strength of its lettings market and its high levels of institutional stability. This latter point counts for a great deal, as it allows a clear view ahead to the medium term – a rarity in the current climate. France has also benefited from the fall of the euro against most other world currencies, giving French real estate a competitive advantage with the promise of a potential upside.

As a result of all these considerations, international investors accounted for 46% of France’s total investment volume at the close of 2019, compared with 39% a year earlier.

As predicted, the wave of South Korean investors became much more subdued in Q1 2020. Rushing in to take their place were new entrants from North America (both the US and Canada) and the Middle East. German investors were also very active and seem committed to increasing their exposure to the French market.

Over the coming months, we expect to see sustained high demand for Core properties at the international level, given the attractive yield spread on offer. However, it is also possible that international investors will find more attractive Value Add opportunities in other countries, and re-evaluate their activity in France.