ECONOMIC OVERVIEW

- The Czech economy expanded by 2.5% in 2019, slightly slower than in 2018 (2.9%). Further deceleration to around 2% is expected in 2020, primarily due to weakening household consumption, which is currently the main economic driver.

- The unemployment rate stayed the lowest in the EU, falling back to 2.0% in December 2019. During 2019, unemployment in the Czech Republic most probably reached its lowest point and in 2020 is forecast to slowly climb to around 2.3%.

- Average nominal wage growth in 2019 is expected to reach 7.0%, following 7.6% growth recorded in 2018. In 2020, wage growth is projected to decelerate to 5.6%.

- Inflation rate reached 2.8% in December 2019, well above the 2% ČNB target, but still within the tolerance band. The annual average inflation rate for 2019 reached 2.8% (slightly above 2018).

PRAGUE OFFICE MARKET HIGHLIGHTS

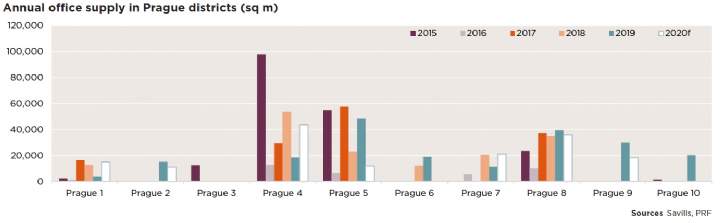

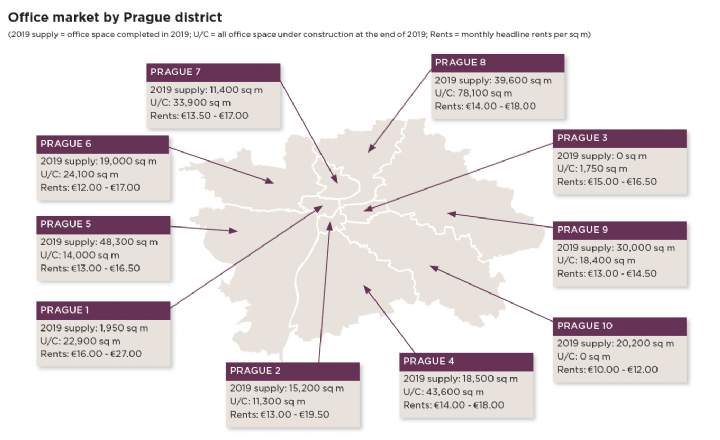

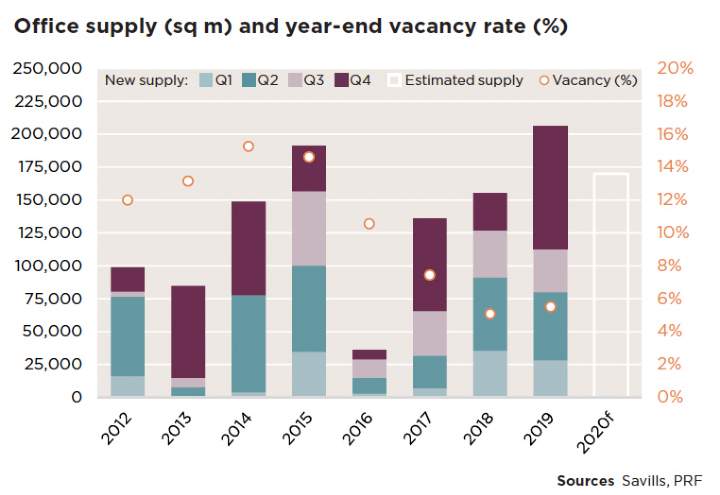

- 206,000 sq m of office space was delivered to the Prague market in 2019, which is the highest annual supply since 2008.

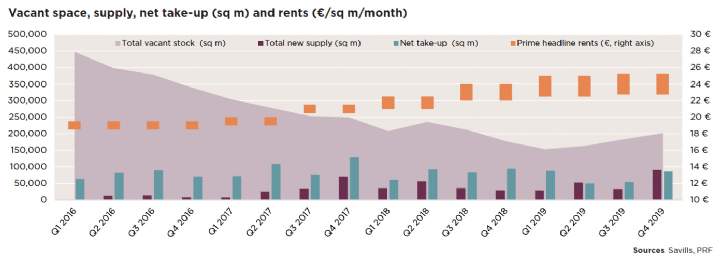

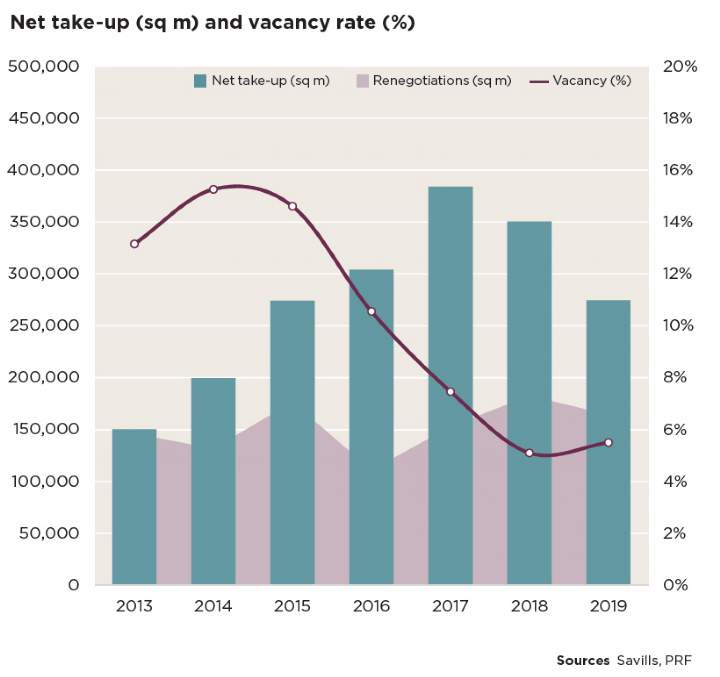

- Modern office stock in Prague reached 3.69 million sq m, while 201,000 sq m of that was unoccupied at the end of the 2019. This translates into a vacancy rate of 5.5%, which is 114 basis points (bps) above the 2018 year-end vacancy rate.

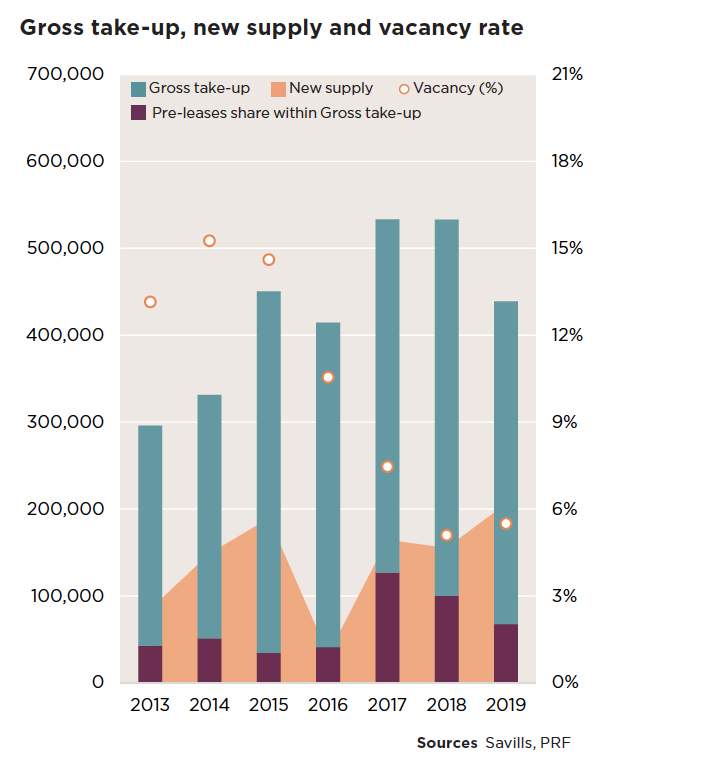

- Annual gross take-up in 2019 amounted to 439,000 sq m, (18% below last year’s level). Net take-up activity followed a similar downward trend and added up to 274,600 sq m (21% below the 2018 figure).

- In 2019, the flexible office sector accounted for 3% of annual gross take-up and 5% of annual net take-up, which was down by nearly half compared with 2018.

.jpg)

.jpg)