Stable with a clear view ahead

Compared with its main neighbours and trading partners, France’s economy is proving remarkably resilient. Although growth forecasts have been downgraded more or less everywhere as the overall outlook darkens, France seems to have been spared the worst. There may be nothing spectacular about the country’s recent economic performance, but it does offer a certain stability in a volatile and increasingly unpredictable climate – a solid advantage in the eyes of investors.

Slow, steady and sustained, the French economy is currently making a virtue of consistency, with overall growth coming in at 0.3% for the third consecutive quarter. No cause for complacency, certainly, but with global economic forecasts growing gloomier by the day, France is looking like a relatively safe bet. In fact, figures for Q3 were slightly stronger than generally expected. The growth rate carried over at the end of the quarter stood at 1.2%, up from 1.1% in June. The latest forecasts for the end of the calendar year suggest an annual growth figure of between 1.3% and 1.4%, with little change on thecards for 2020.

Compared with the recent performance of many other European economies, this almost makes France a winning prospect. In the United Kingdom, despite similar levels of market activity, economic growth has been tailing off for some time, and figures for Q3 fell short of expectations. Germany has narrowly avoided official recession territory this quarter, but its economy is not anticipated to grow by more than 0.5% in 2019, rising to between 1% and 1.2% in 2020. Finally, the Italian economy remains stuck in the doldrums and is likely to end the year on an annual growth figure of just 0.1%, although again the forecast for 2020 (0.6%) is slightly brighter.

The way the French economy is structured, with a lower degree of exposure to the oscillations of international markets than many other countries, explains its ability to sustain this almost salutary performance. Exports of goods and services account for just 31% of France’s GDP; in Germany, it’s nearly 50%. This means that the progressive deterioration of the international climate amid tensions between the USA and China has less of an impact on France.

Its economy remains primarily driven by domestic demand, whether in the form of household spending or corporate investment. Many companies are taking advantage of low interest rates to upgrade their capital assets, pushing corporate investment up by 1.2% at the close of Q3. Meanwhile, household spending was up 0.3% at the end of the quarter. There are two main factors behind this boost in consumer confidence. First, the labour market is performing strongly; unemployment has been falling slowly, and this is expected to continue over Q4, reaching 8.3% of the active population by the end of the year. Second, households have enjoyed a bump in purchasing power, also likely to continue through Q4 as the latest round of cuts to the residence tax come into effect. Overall, by the end of 2019 French households should have seen their purchasing power grow by 2.3%, compared with just 1.8% in 2018.

The relative stability and resilience of the French economy appears to be giving it an edge in a particularly volatile global climate. Effectively, these qualities give investors and other financial decision-makers a clearer idea of what the future might hold in the medium term.Indeed, the perception of France as a relatively safe harbour is driving a good deal of the interest we are seeing from international investors.

.jpg)

Market Trends in Ile-de-France

A slackening pace

With transaction activity not far off the ten-year average, the performance of the greater Paris rental market in 2019 produced little in the way of upsets. Quarterly take-up has essentially remained stable since the start of the year, with a total of 543,400 sqm let over the last three months.

Take-up: Just shy of average

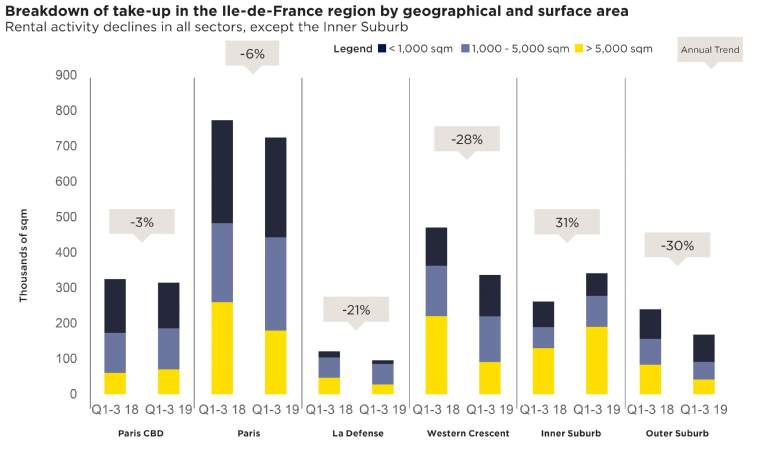

Since 2019 began, a total of 1,655,000 sqm of office space has been let in Île-de-France – a perfectly respectable figure and close to the ten-year average (estimated at 1,690,000 sqm). Nevertheless, this constitutes a marked decline (-11%) in comparison with 2018, despite a welcome summer surge.

There has been little significant change in market conditions since the start of the year. Once again, the average was pulled down by the major transactions segment (i.e. deals involving floorspace in excess of 5,000 sqm), where activity fell by 29% year-on-year. This difference can be seen both in the number of transactions and in the scale of completed deals. There have been 50 completed transactions so far in 2019, down from 59 in 2018. When we look at floorspace, again the downward trend is clear; the majority of this year’s completed transactions have involved smaller properties. Just five deals for office space of more than 20,000 sqm have been completed this year (SNCF, Société Générale, Crédit Agricole, Société du Grand Paris and EDF) and none at all in the >35,000-sqm bracket. The market was significantly livelier in 2018, with eight completed transactions for spaces of more than 20,000 sqm – including three that exceeded 40,000 sqm (Vinci, Technipand Nestlé).

It was all but inevitable that we would see a slowdown in the major transactions segment in 2019, given that the figures for 2018 were so strong. However, there are two other factors at work here: the dearth of available supply and the fact that many leases agreed at a time when rental values were generally lower are now reaching the end of their terms. Given the choice, many major tenants are therefore focused on negotiating a new deal for the property they are already occupying.

At the other end of the spectrum, the small transactions segment (i.e. floorspace of less than1,000 sqm) is faring better, although activity has dropped in this part of the market as well, with a year-on-year decline of 3%. As more and more smaller occupiers are swept up by the co-working juggernaut, the resilience of this segment almost feels like a coup. This remains a key segment of the market, representing 33% of take-up in the Île-de-France region as a whole. Finally, it is only in the middle of the range (1,000 to 5,000 sqm) that we find signs of positive growth; with activity up 3% year-on-year, this segment is still the driving force of the Paris lettings market, accounting for 35% of all transactions in the office sector.

In terms of geography, the Inner Suburbs have been out in front since 2019 began, with the most upbeat market in the region. In fact, this is the only market to post significant year-on-year growth (+31%), buoyed by a more ample supply, attractive rental prices, good public transport links and proximity to the city’s established business districts. Elsewhere, there has been a general slackening off, but not all areas are affected to the same degree – the drop in activity ranges from -6% in central Paris to -30% in the Outer Suburbs.

Paris

Take-up in Paris has now reached almost 713,500 sqm, with most of the action concentrated in the CBD (44%), the 14th and 15th arrondissements (14%) and West Central Paris (13%). This amounts to an 8% drop in comparison with 2018. The French capital remains the jewel in the crown of the Île-de-France lettings market, representing 43% of take-up, but Paris is now feeling the pinch of a severe shortfall in supply; the vacancy rate at the close of Q3 stood at just 2.2%.

Within the city limits, the primacy of the CBD remains undisputed, almost managing to buck the general trend. Despite a historically low vacancy rate of just 1.3%, the CBD is holding its own – at 324,300 sqm, take-up here is fast approaching 2018 levels. The summer months were especially upbeat, with a spike in demand for large and medium-sized office space (up 3% and 16%, respectively). In contrast, there was a distinct slump at the other end of the scale, with demand for smaller spaces down 15%. This is almost certainly due to the exuberant growth of the co-working sector in the heart of the city. Still, there are some signs that this trend may have peaked. Co-working operators have been riding a wave of demand for more than two years now and have been particularly keen to court occupiers looking for larger spaces, but this summer brought a very noticeable slowdown. Speculation surrounding WeWork – the market leader in Paris with around 15 completed transactions in 2018 and 2019 at an average floorspace of 9,000 sqm – and its business model have not helped matters.

At the moment, the co-working sector seems to be regrouping around alternatives to the WeWork model, at least in its current form. Deskeo, which was snapped up by the US company Knotel at the start of this year, has been doing particularly brisk business in the small and medium-sized office segment. It was involved in around twenty deals (for spaces ranging from 500 sqm to 3,200 sqm) in central Paris, representing a total area let of almost 22,500 sqm.

Moreover, the co-working market has now sprouted a ‘luxury’ branch, spearheaded by new entrants such as Welkin & Meraki. A Belgian company that only recently arrived in Paris, it has now opened a second co-working space of almost 3,000 sqm in Rue de Surène. This trend towards premium co-working spaces is very likely to catch on, and we expect to see more of them cropping up across the city in the coming months.

Finally, there are a number of new operators just finding their feet in the Paris market, including the British company The Instant Group, which is betting on a bright future for Paris’s flexible office sector in a post-Brexit climate.

La Défense

The third quarter of 2019 brought no change in fortunes for La Défense; this prime business hub is still performing well below its potential. The first nine months of the year saw take-up of less than 100,000 sqm, marking a substantial year-on-year decline (-21%). Although there were two major transactions here, with both WeWork and Loxam leasing spaces larger than 5,000 sqm, a sluggish performance in the first half of the year is dragging down the overall figures. However, with a raft of new supply expected to hit the market in the next few months, there is still a good chance that activity will start to pick up.

The Western Crescent

Flagging since the beginning of the year, the Western Crescent market is still contracting rapidly (down 28% y-o-y). Take-up here stands at 336,400 sqm, split mainly between the South End (37%), Péri-Défense (36%) and Neuilly-Levallois (22%). While both Neuilly-Levallois and the North End have surged ahead, boasting some very encouraging figures, they cannot compensate for the full extent of the drop-off in Péri-Défense. A key market for the entire the Western Crescent, Péri-Défense has failed to live up to its 2018 performance, particularly in the major transactions segment.

The Inner Suburb

If there’s one bright spot in the Paris lettings market, it’s here; the Inner Suburbs are breezing through the year with aplomb. With a total area let of 341,500 sqm so far, there has been a marked upturn in activity (transactions are up 31% compared to 2018), and the market is performing strongly in both the northern and eastern zones. Much of the credit is owed to the completion of some very major deals, three of which involved floorspace of over 30,000 sqm. St-Denis (North Inner Suburbs) was the location of choice for SNCF and Société du Grand Paris, whereas Société Générale opted for Fontenay-sous-Bois (East Inner Suburbs). To the south, the step-up since 2018 is less pronounced, simply because last year’s performance was already strong. Take-up, however, has remained relatively stable, thanks in part to transactions involving Crédit Agricole and EDF in Montrouge.

The Outer Suburb

Meanwhile, take-up in the Outer Suburbs is down 30%. Occupiers have tended to give more weight to proximity to the main business hubs, leaving the Outer Suburbs to fall back on internal demand. The sole outlier is Pôle de Roissy, where take-up rose by 16%.