OFFICE STOCK & SUPPLY

Two office buildings were completed in Prague during Q3 2019 and one additional property was refurbished and added back to the city’s modern office inventory. As a result of these completions, the total office stock in Prague grew by 33,000 sq m and currently stands at 3.6 million sq m. Grade A office inventory stood at 2.63 million sq m.

The two new deliveries included the Argentinská Office Building (5,800 sq m) in Prague 7 and Dock In Three (16,100 sq m), Crestyl’s third office building out of a total five within their Prague 8-based scheme. VIG carried out the full refurbishment of BB Centrum C Life building in Prague 4, which was initially built by Passerinvest in 1998.

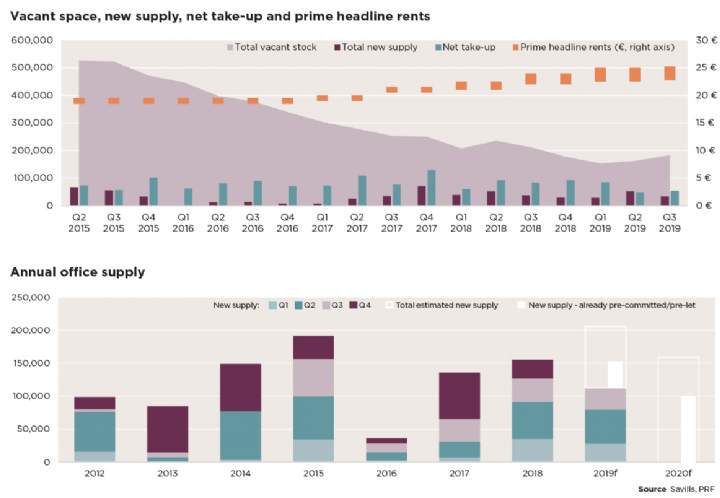

Nearly 113,000 sq m of modern offices were supplied to the Prague market during the first three quarters of the year, which was 12% down y-o-y. However, if all of the premises scheduled for completion during Q4 are completed on time, the total annual supply in 2019 would reach ca. 206,000 sq m, which would be the highest level since 2008.

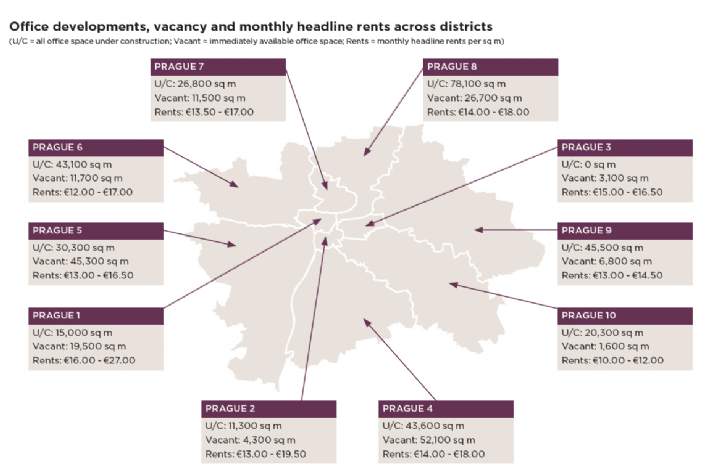

At the end of Q3 2019, the city’s construction pipeline included 316,800 sq m of mostly new office developments, which should all be completed by the end of 2021. Nearly 40% of all this space was pre-committed.

VACANCY

By Q3 2019 the vacancy rate in Prague had climbed by 54 bps from Q2 to 5.1%, which translates into almost 183,000 sq m of unoccupied modern office space.

This marginal increase in the volume of immediately available office space was partially caused by new speculative space totalling 17,600 sq m that was delivered to the market during Q3, and also by some second-hand space becoming vacant in grade A as well as grade B offices across the city.

Unoccupied office space was evenly distributed across grade A and grade B office buildings. Both of these stock categories closed the third quarter at a 5% vacancy rate.

53% of all unoccupied space was found in Prague’s biggest office districts, Prague 4 and Prague 5. Prague 4 was offering more than 52,000 sq m for immediate occupation and almost 45,300 sq m was available in Prague 5.

Assuming that all six buildings that are scheduled for delivery by year-end complete construction on time, up to 40,000 sq m of speculative office space will be added to the Prague market in the final quarter of 2019. With demand cooling, this speculative development could push up the vacancy rate slightly.