Further yield compression prospects in Eastern and Southern European markets

Office Yields

European prime office yields hardened by an average of 9bps during Q3 2019 to 3.45%. Amsterdam offices hardened by 50bps (more than any other city) to 3%, followed by Lisbon (-25bps to 4%) and London City (-25bps to 4%) as investors considered London attractively priced despite Brexit uncertainty. Munich moved in a further 20bps during Q3 and now stands at 2.7%, the lowest of all European cities, as Germany remains a safe haven despite the economic slowdown.

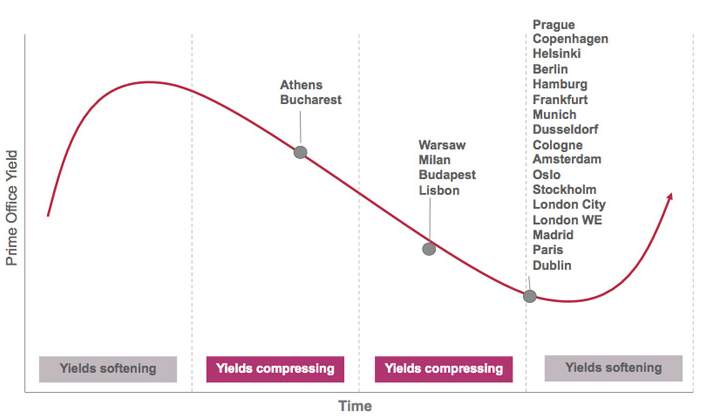

Looking forward, Savills Research forecast that there is the most room for prime office yield compression in the Athens and Bucharest markets over the next 12 months. Warsaw, Lisbon, Budapest and Milan could also see some additional yield hardening during this period as the demand for prime assets outstrips supply, however, the majority of core markets expect stable yields during the forecast period (see below).

Prime office yield wave – Q3 2019

Source: Savills Research

Retail Yields

So far in 2019, the average gross initial yield achieved is 25bps higher compared to last year at 6.47% a reflection of both the softening trend in retail yields as well as the rising number of value-add type of transactions.

Prime shopping centre and prime retail warehouse yields are converging slightly below 5%. The average prime shopping centre (4.74%) moved out by 17bps annually with strong adjustment recorded in London, Paris and Madrid (50bps), whilst in Warsaw and Lisbon, the prime yield moved in by 25bps YoY. In the same time, the average prime retail warehouse yield (4.83%) hardened by 10bps YoY notably due to downward price correction in London (75bps), Paris (50bps) and Madrid (25bps), whilst the format remained particularly resilient in Dublin (-50bps) and in the top six German cities (from -20bps to -40bps). Over the past twelve months, the average prime high street yield (3.48%) remained stable with still inward movements recorded in Lisbon (-50bps) and in the major German cities (from -10bps to -30bps).

Industrial Yields

Industrial prime yields hardened by an average of 17bps over the third quarter to 4.49%. Stuttgart hardened by an average of 50 bps to 3.9%, followed by Munich, Hamburg and Berlin, all hardening 40bps. Berlin is now the most keenly priced industrial market in Europe currently at 3.7%. Paris IDF yields also compressed a further 25 bps as land costs remain at a premium.

12-Month Outlook

Office

As the European economy edges nearer to full capacity, office job growth will be positive, but more modest than in recent years. European occupiers will therefore be more cost-conscious as productivity moderates, and will therefore look to adopting new workplace strategies to boost output.

Flex offices will continue to grow as space-as-a-service becomes more mainstream across European markets and could exceed 13% of total office demand in 2020 and those cities with higher-tech occupier bases will see the strongest increases. Naturally, the more traditional lease will work more effectively for corporate occupiers who are planning their real estate decisions on longer time frames.

Rental growth will begin to taper from the 4–6% pa levels we have witnessed in recent years to more sustainable levels in the next couple of years. Speculative development will be less likely across core cities as rental growth is outpaced by development cost growth. Funding partners will be more attune to lending to at least part-pre-let schemes and on the basis that input costs are fixed. Scarcity of labour in Western Europe will be one of the main issues in delivering new space.

Logistics

Long-term borrowing costs remain low, or negative across Europe, with the Germany 10Y bond yield at -0.65% and France 10Y bonds yielding at -0.35%, which will maintain an attractive yield spread for logistics real estate going forward. Investors will be paying close attention to each city’s development pipeline which will reflect the relative risk premium between countries. Likewise, the likely prospect of strong rental growth across Europe’s most urbanised cities and low Eurozone inflation will be factored into logistics yields.

Indeed, investors will be eagerly analysing pricing relative to other commercial property sectors. In the UK, for example, prime industrial yields (4.00%) are currently 90bps below the all-sector average, whereas 24 months ago, prime yields were 4bps above the all-sector average. This is a shift we could see transpiring in the most constrained European markets over the next 18–24 months. Looking forward over the next 12 months, further industrial yield compression is expected across Germany, France, Portugal, Greece, Sweden, Czech Republic and Romania.

Retail

Overall repricing, repositioning and repurposing will be the leitmotiv of retail investment activity in the next 12 months.

Further prime yield softening is expected in the sector notably in the UK, France, Norway, Sweden, Spain and Portugal, whilst it should remain stable in Germany, Netherlands, Italy and Poland. Romania will be the only exception where further inward movement is anticipated in the coming year. Repricing will bring more opportunities to the fore, including a growing number of portfolios. It may notably convince some retailers to sell their properties in anticipation of continuing downward price correction. Hence, we expect the number of SLB deals to keep increasing.

As the role of physical retailing is rapidly evolving, bringing in its wake new concepts requiring adjustment and adaptation, there is growing upside opportunities for value add investors to look into repositioning options of prime existing schemes. The rise of e-commerce will inevitably lead to more rationalisation movements. Some existing secondary retail formats may be repurposed to service the rising property needs of e-commerce to provide local fulfilment centres, click and collect points or urban warehouses for last-mile delivery.