Poised for the green light

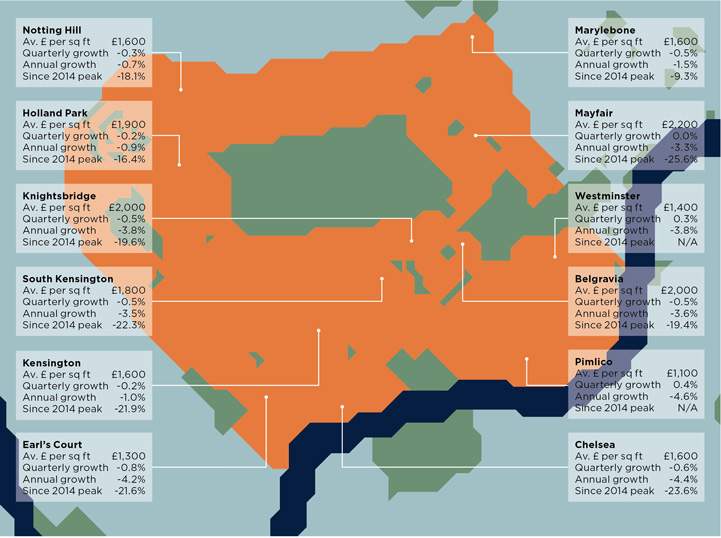

Prime property values to September 2019 (excludes new build)

Source: Savills Research

Prices in the prime housing markets of central London slipped by a modest 0.3% in the three months to the end of September. Despite a backdrop of intense domestic political uncertainty, this was the smallest quarterly adjustment of the past four years.

On average, the value of the capital’s most expensive housing stock has adjusted by 20.4% since the market peaked more than five years ago. The extent of price falls varies little by price band, size, or type of property or, with the exception of Marylebone, location.

Such an adjustment is comparable with falls seen post the Global Financial Crisis and in the downturns of the late 80s and then the early 90s. In common with those downturns, the adjustment is greater still for those buying in a foreign currency given the depreciation of sterling. For a US dollar buyer, there has been an effective price adjustment of more than 40%.

There is evidence of a growing pool of domestic and international money waiting to exploit the resulting buying opportunity. However, the ongoing uncertainty around how Brexit will play out and what this will mean for the wealth-generating parts of the London economy, the domestic political backdrop and the value of sterling, means potential buyers have so far remained cautious to do so.

Rebalancing demand and supply

The reluctance of buyers to take advantage of the value on offer in London has done little to encourage sellers to bring new stock to the market. Data from LonRes indicate that the number of £1m+ central London properties that were brought to the market in September was 27% down year on year and led to a 10% reduction in property being publicly marketed.

So, while political uncertainty is unsurprisingly seen as the main factor holding back the market, our agents report that a lack of stock is now regarded as a bigger constraint than taxation.

This position has not been helped by speculation of a cut in stamp duty, which 71% of our agents across the prime markets of London believe has had an impact on sales volumes.

Against a backdrop of rising prospective buyers, this raises the prospect of a demand and supply imbalance once those potential buyers decide the time is right to re-enter the market.

Given the extent to which prices have already corrected, we do not envisage significant further price adjustments in the short term

Savills Research

Outlook

We expect the sense of caution in the market to continue for the rest of the year, as buyers wait to see whether the current government will be able to negotiate a deal with the EU before the end of October, or forced by parliament to seek a further extension of Article 50. The prospect of a general election by the end of the year is likely to add to this. However, given the extent to which prices have already corrected, we do not envisage significant price adjustments during this period.

Current polling shows that the election of a hard left majority government would require a substantial swing in voting intentions. This limits the risk of a dramatic change in the political environment which might significantly alter the attractiveness of London to ultra-high-net-worth individuals. But only once this risk has passed entirely do we expect the seeds of recovery to be planted.

We also believe that cuts to stamp duty that were mooted by Boris Johnson in his leadership bid cannot be relied upon. First, it’s uncertain whether the Conservatives can deliver a clear majority. Also, any government is going to be reluctant to put at risk receipts which we estimate to be between £2 billion and £4 billion, at a time when it will be looking to increase spending to support the economy.

Deal or no deal, what is needed to stimulate market demand is greater certainty over the way forward. That is likely to coincide with a bottoming out in the value of sterling which should act as a trigger to unlock pent-up demand.

Interested in other areas of the UK?

View all of our latest prime Market in Minutes research here.