Price-sensitive market continues

Prime rental values to September 2019

Source: Savills Research

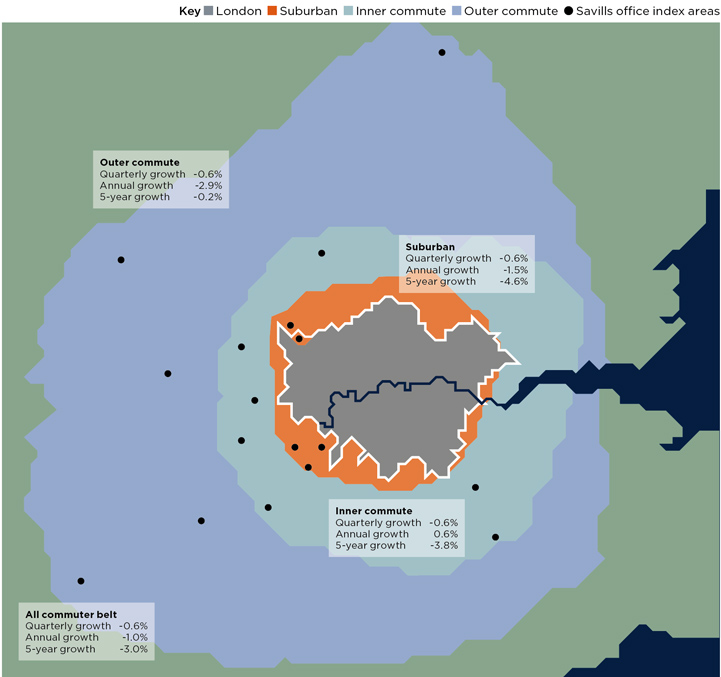

Rents of prime property in the commuter belt fell by 0.6% over the third quarter of 2019, leaving them 1.0% below where they stood a year before, in a market that has witnessed modest year-on-year rental falls since 2016. Recent falls have been driven by prime properties in the capital’s suburbs and commuter markets more distant from London. Meanwhile, rents in the commuter market closer to London, including locations such as Beaconsfield and Guildford, have seen marginal growth of 0.6% during the past 12 months.

Accidental landlords renting out their home while waiting for Brexit uncertainty to clear, continue to add to rental stock in the market, particularly at the top end.

Families and young professionals alike are continuing to rent in an area before buying as they wait for some certainty to return to the sales market.

With 41% of tenants in the commuter belt working in London, transport links are important, with many favouring well-connected cities and towns such as Cambridge, Sevenoaks and Harpenden. Local schools and amenities are influences too.

Against this market backdrop, landlords need to ensure they are presenting their properties in the best possible condition to attract tenants over the longer term. High levels of stock also mean realistic pricing and being flexible on terms is paramount to securing quick lets and minimising voids.

Value in the commuter belt

Prime commuter belt rents offer a substantial saving compared with London, and this continues to drive demand. Across the prime commuter belt, the average price is £16 per sq ft per annum.

For prime London, the average is £37 per sq ft per annum. The value differential is a key incentive for young professionals and families to move out of London, with 21% of tenants moving from London into the commuter belt.

Variation in size

Our research shows that rental values of smaller properties have been more robust during the past five years. Demand is mainly underpinned by younger families and professionals. As a consequence, rental prices for one- and two-bedroom properties have seen five-year growth of 7.1%.

Demand has been thinner for larger properties. Those with five or six-plus bedrooms have had five-year rental falls of 5.1% and 12.0% respectively. Although rental growth for larger properties fell by 1.3% during the past year, these falls are starting to slow, with the first signs of a pick-up in demand.

Outlook

We expect the imbalance between supply and demand in the current market to delay any substantial price growth in the short term. Properties in immaculate condition, in the most popular locations with good transport links and schools will continue to outperform the rest of the market.

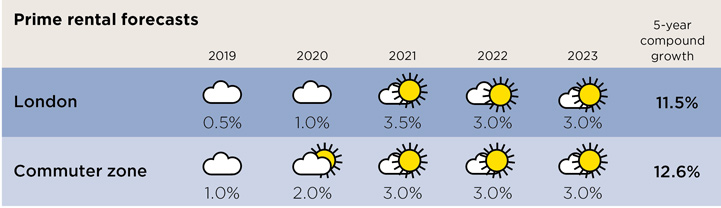

Across the prime commuter belt markets as a whole, we expect rents to rise by 12.6% in the five years to 2023, outperforming the prime London market.

Landlords will need to remain competitive on pricing and flexible on terms, as well as ensuring properties are presented in the best condition to attract tenants and maximise returns.

Source: Savills Research | Note: These forecasts apply to average rents in the second-hand market. New build values may not move at the same rate

Interested in other areas of the UK?

View all of our latest prime Market in Minutes research here.

.jpg)