Prime West London resilient despite uncertainty

Prime property values to September 2019 (excludes new build)

Source: Savills Research

Despite the ongoing challenges faced by London’s prime residential markets in the third quarter of 2019, price falls continued to slow as buyer and seller expectations narrowed.

Brexit was cited by more than two-thirds of our agents as the main issue currently affecting the market. In addition, more than 90% reported that buyers and sellers were concerned about the possibility of a general election.

Values of prime housing in West London have fallen by 10.0% on average since 2014, when new stamp duty rates were introduced

Savills Research

The mainstream markets of London have been affected by similar concerns, causing average price falls across the wider housing market of 2.6% in the last 12 months. Yet in the three months to September 2019, values across the prime housing markets of London fell by a marginal 0.3% on average, leaving them just 1.5% lower than 12 months previous.

In common with the wider prime London market, West London has seen price falls continue to ease. Here, values of prime housing have fallen by a total of 10.0% on average since 2014, when new stamp duty rates were introduced. This has had a particular impact on the top end of the market. Properties worth £2m or more have seen prices fall by 15.0% since 2014.

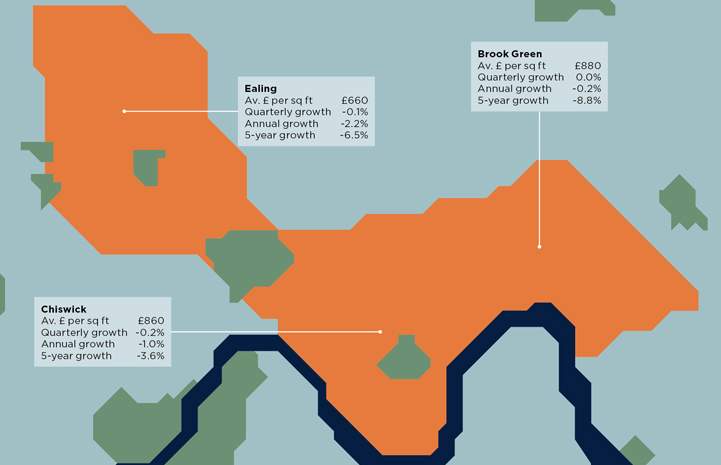

Since the EU referendum, uncertainty around the economic impact of Brexit has led buyers to become more cautious in this predominantly domestic part of London. But prices in the region, which covers Brook Green, Chiswick and Ealing, essentially remained flat (-0.1%) in the three months to September, leaving them 1.0% lower than a year ago.

In part, this reflects the fact that uncertainty has also led to fewer prime properties being brought to the market. At the same time, we’ve seen higher levels of new applicants this year, creating a build-up of demand. But this remains a market that requires pragmatism from buyers and sellers alike.

Local buyers keep the market moving

In the prime markets of Chiswick and Brook Green, where values average £870 per sq ft, prices have fallen by more than 12% since their 2014 peak. But falls have slowed to -1.0% and -0.2%, respectively, over the last year.

These districts are dominated by families, the vast majority of whom (69%) are upsizing in the area. Such buyers continue to be the bedrock of demand in a needs-based market, irrespective of its price-sensitive nature. Both locations are seen as attractive places to settle for the long term and consequently over half of buyers move from within nearby postcodes.

In the prime markets of Ealing, young professionals play a much more important role. Values here average at £660 per sq ft, having fallen by a lesser -6.6% since 2014 and by -2.2% over the past 12 months.

Those looking for more space often take advantage of the relative value on offer here, which continues to be a strong driver of demand. To put this into context, in Chiswick or Brook Green, buyers can expect to pay £1 million for a small terrace or a large flat while in Ealing they could get a large semi-detached or small detached house.

Outlook

We expect the sense of caution in the market to continue for the rest of the year, as buyers wait to see whether the current government will be able to negotiate a deal with the EU before the end of October, or forced by parliament to seek a further extension of Article 50. The prospect of a general election by the end of the year is likely to add to this. However, given the extent to which prices have already corrected, we do not envisage significant price adjustments during this period.

Current polling indicates that the election of a hard left majority government would require a substantial swing in voting intentions. This limits the risk of a dramatic change in the political environment. But only once this risk has passed entirely do we expect the seeds of recovery to be planted in the prime London market.

We also believe that cuts to stamp duty that were mooted by Boris Johnson in his leadership bid cannot be relied upon. First, it’s uncertain whether the Conservatives can deliver a clear majority. Also, any government is going to be reluctant to put at risk receipts which we estimate to be between £2 billion and £4 billion, at a time when it will be looking to increase spending to support the economy.

Deal or no deal, what is needed to stimulate market demand is greater certainty over the way forward.

In West London, needs-based, local buyers continue to keep the market moving, particularly those in search of good schools, green space and connectivity to central London.

We anticipate this will continue in the short term.

Interested in other areas of the UK?

View all of our latest prime Market in Minutes research here.