An update on housing delivery in London

- Housing delivery in London remains at near record levels, but still a considerable way off the target

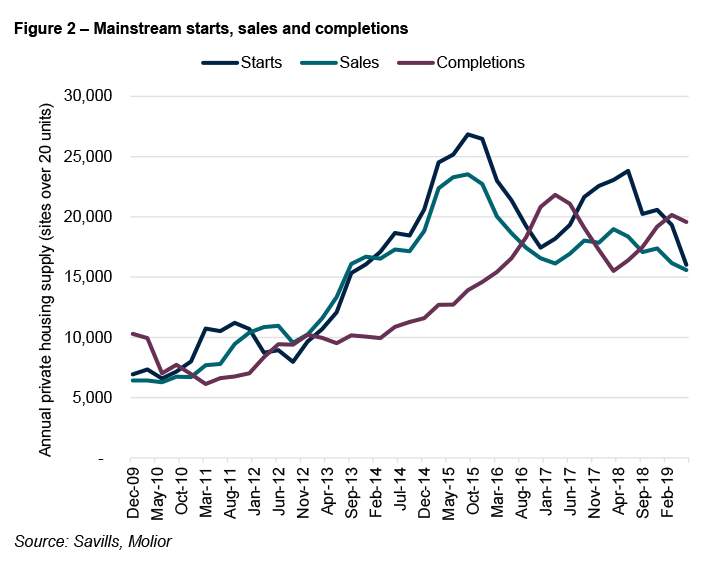

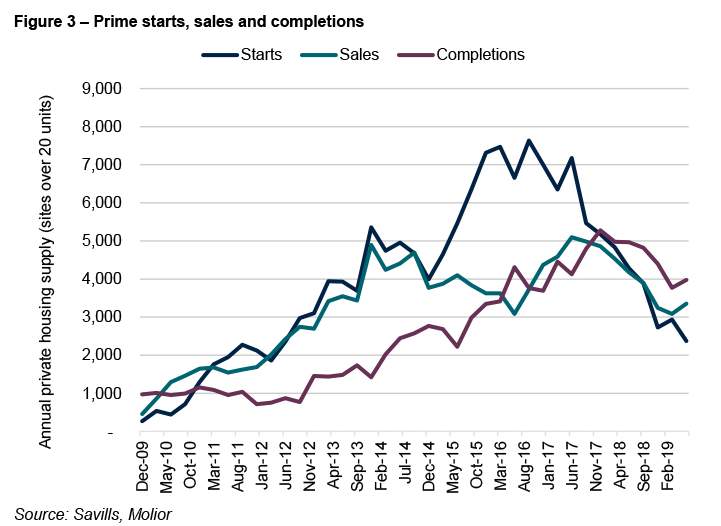

- Construction starts continue to slip in the prime and mainstream markets

- Affordable homes delivery has remained relatively stable according to most recent data

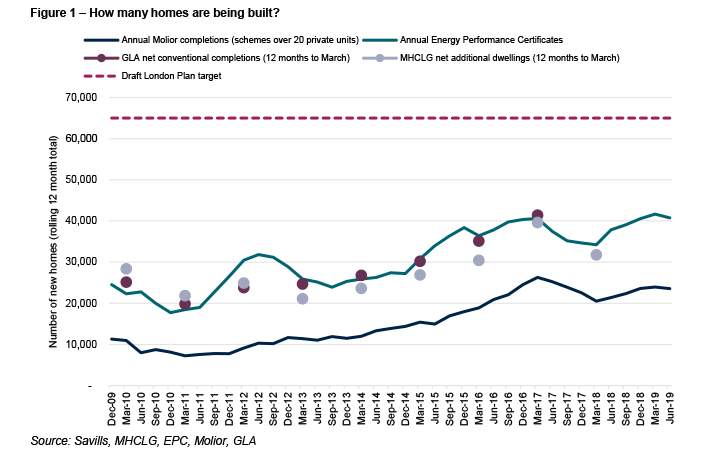

The number of homes built in London remained at near record levels in the second quarter of 2019. The latest new build Energy Performance Certificates (EPCs), an unofficial leading indicator for total housing delivery, show 40,735 new build EPCs issued in London in the year to Q2 2019. This is a slight fall from the previous quarter, however 12 month delivery is 8% up on Q2 2018. Although, in comparison to the rest of the country, the number of homes being built in London is rising at a slower rate than the other regions.

Molior’s data (for private units on sites over 20 units) shows a similar trend to the EPC figures , increasing 10% year on year, with 23,554 private units being delivered in the 12 months to Q2 2019. MHCLG statistics, recorded as ‘Net additional dwellings’ remain updated to the 12 months to Q1 2018, where they recorded 31,723 homes delivered in London. These figures tend to undercount, as shown in Figure 1.

The official data for London new build supply – the GLA’s ‘Net conventional completions’ - will be updated in summer 2019 –those figures will cover the 12 months to Q1 2018. Despite the latest statistics showing housing delivery numbers in London remaining at significantly higher levels than any time in the last decade, the figures are still a long way off meeting the draft London Plan target figure of 65,000 homes annually and well below Savills’ own need estimate of 94,000 homes per annum.

.jpg)

.jpg)