As predicted, H1 investment volumes below mean levels

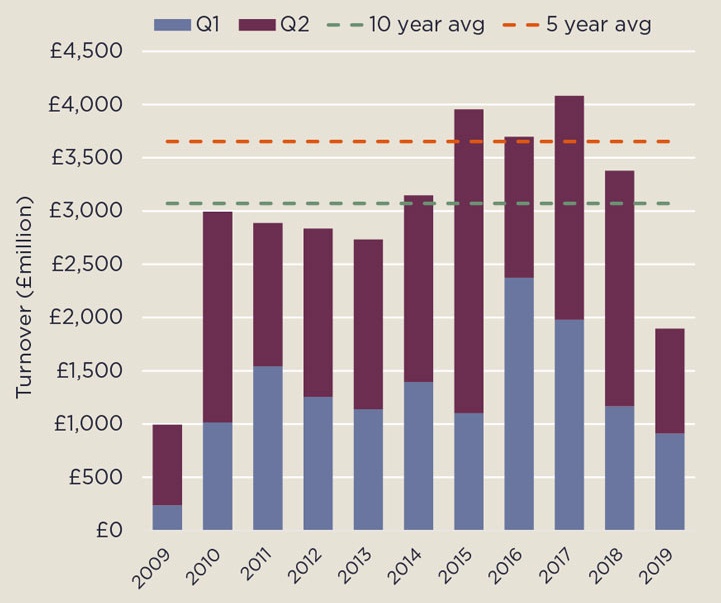

June has witnessed investment volumes of approximately £171m across eight transactions, bringing Q2 2019 turnover to £986m across 20 transactions. This is only 8% ahead of first quarter activity in volume terms - where we have historically observed +30% more investment in the second quarter - and is constant in terms of deal number as activity continues but at subdued levels. Investment turnover for the first half of 2019 reached £1.89bn across 40 transactions, down 48% and 38% on five- and 10-year average investment volumes across the same period, respectively (see Graph 1).

GRAPH 1 | H1 investment turnover

Source: Savills Research

Clareville House, Oxendon Street SW1 is the largest reported deal to have completed in June. This mixed-use and multi-let freehold asset located to the west of Leicester Square totals approximately 57,500 sq ft with 59% of the area comprising offices and the remaining area split by restaurant, retail and bar uses. Just over 60% of current contracted income is derived from the offices, which have a WAULT to expiry of circa 1.4 years and are let off low rents averaging £55.50 per sq ft. The remaining 40% of income is attributable to leisure operators, whose leases have a WAULT to expiry of 14 years. DTZ Investors, on behalf of National Grid Pension Fund, has sold the asset to Motcomb Estates for £66m, reflecting a proposed “topped up” net initial yield of around 4.0% and a capital value of £1,149 per sq ft.

In another sale by a UK fund, Legal & General has sold Heathcock Court, 415 Strand WC2. The property totals 17,785 sq ft NIA, with the vacant office element accounting for 14,493 sq ft and the remainder comprising retail let to Nationwide Building Society for a further 12.5 years. In a location which has been popular among hoteliers and given the buoyant London hotel market, Heathcock Court was offered with a valuable consent for change of use of the upper floors to create a 118-bed hotel. It is understood that it has been acquired by Aprirose for a price in excess of the £25m guide, with an intention to implement the hotel consent.

Though there are a number of substantial assets either reportedly buyable or under offer, 2019 has so far seen a marked absence of big-ticket asset trades. This year so far we have recorded just two properties over £100m changing hands in the West End, compared to an average of 10 deals of £100m plus taking place across the same period every year since 2015 (see Graph 2). We estimate that there are currently nine £100m plus assets either available or under offer.

Though it is easy to attribute subdued activity to Brexit, of relevance is the slowdown in office investment which has been observed in other gateway cities in 2019 when compared to last year*. RCA recorded year on year falls of 49% in both Hong Kong and New York, 43% in Tokyo, 36% in Paris and 50% in Frankfurt to the end of Q1 2019 suggesting our issues may not be as ‘local’ as we might think.

Domestic investors continue to dominate, however, we have noticed an uptick in interest from overseas, notably Hong Kong. This coincides with a weakening in sterling which since the end of May 1 GBP was worth less than 10 HKD, and could also be a response to the recent political unrest.

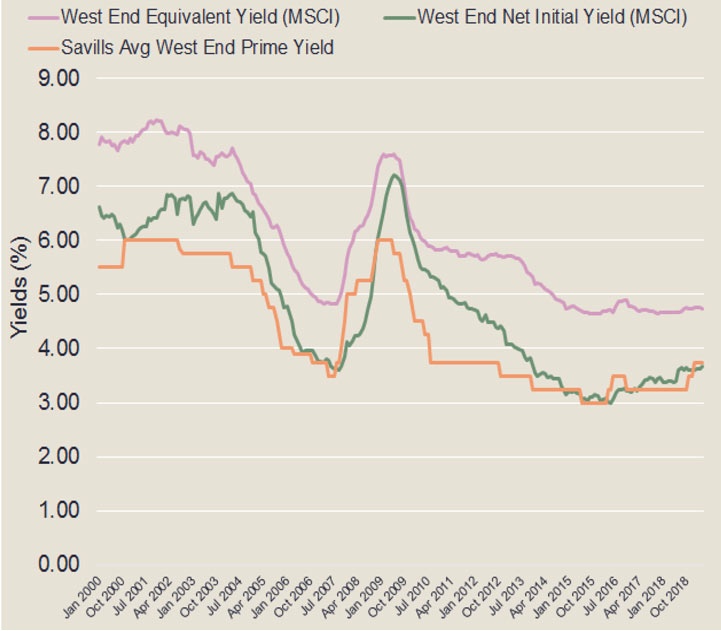

The MSCI average net initial yield has moved out marginally to 3.71% and the equivalent yield stands at 4.75%. Savills prime yield is 3.75% (see Graph 3).

GRAPH 3 | West End yields

Source: Savills Research, MSCI

*RCA data relates to Q1 2018 and Q1 2019.

.jpg)