There’s a sense of opportunity for buyers in London’s super prime residential market

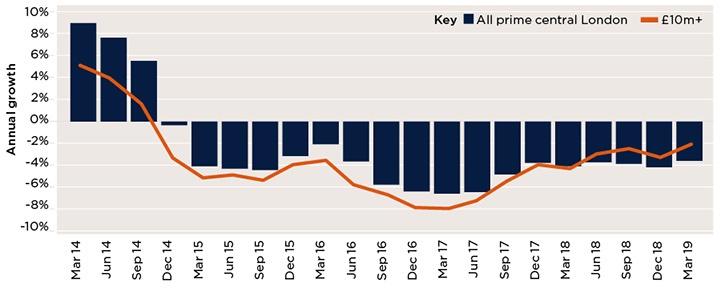

By the end of the first quarter of 2019, the values of the most expensive properties in London’s most prestigious postcodes had adjusted by -21.3% since their peak in 2014. This reflects the fact that the very top end of the market was quickest to respond to changing market conditions, this £10 million-plus market segment being most exposed to the factors that have caused price adjustments more widely across prime central London.

.jpg)

Price monitor Value growth in super prime properties in central London (to March 2019)

Things may be beginning to change. The annual rate of price falls for properties worth £10 million or more has halved over the past 12 months. Significantly, in the first quarter of 2019, prices held their own for the first time in more than five years. This points to a market that is looking increasingly good value for a wide range of international buyers, despite the uncertainty surrounding Brexit and the market’s adjustment to greater exposure to UK taxes. Combine this with falls in the value of sterling, property worth £10 million or more is now 40% cheaper than it was at its peak for someone buying in US dollars. This has supported market activity.

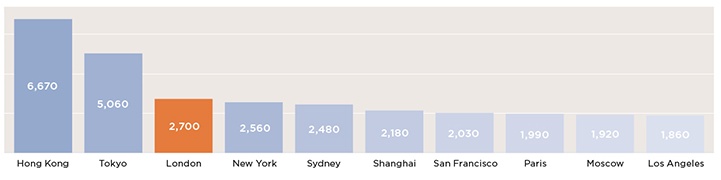

It also means that average values (on a £ per sq ft basis) for ultra prime London property in areas such as Knightsbridge, Belgravia and Mayfair, are now only marginally higher than equivalent properties in New York and Sydney (see below). They are substantially less expensive than in Hong Kong.

Ultra prime league The average price in London for a comparable ultra prime property is now only marginally higher than New York and Sydney (on a £ per sq ft basis)

Source: Savills Research

Encouraging signs of activity

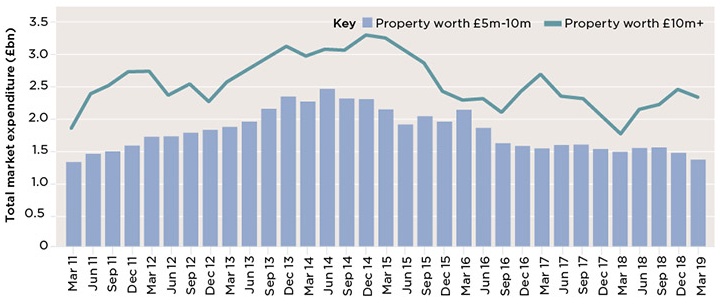

Despite a relatively muted level of activity in the first three months of 2019, £2.36 billion of property worth £10 million or more transacted in the year to the end of March. This reflects the ongoing appeal of trophy homes in central London’s most exclusive locations.

Slightly weaker market activity was seen in the market between £5 million and £10 million, as the level of political uncertainty in the UK made buyers in this part of the market more cautious about taking advantage of the value on offer.

That said, in a market where 80% of ultra-high-net- worth buyers originate from outside the UK, applicant activity was up 35% year on year. For this group of buyers, London remains an attractive place to live and invest, with 50% buying property worth more than £5 million as their main residence.

Annual price movement At the top end, the rate of falls continues to slow

Source: Savills Research

Market activity Spending on £10m+ properties hit £2.36bn in the year to Q1 2019

Source: Savills Research

OUTLOOK

Against a backdrop of continued political uncertainty, we expect the prime London market to remain price sensitive over the remainder of 2019 and through 2020.

However, we believe unfolding clarity surrounding Brexit is likely to result in a gradual improvement in market activity.

Once uncertainty clears, we expect to see a bounce in values as more buyers look to benefit from the currency advantage on offer. While a general election pencilled in for 2022 has the potential to interrupt a recovery, increasing levels of global wealth are expected to underpin sustained demand for the very best London residences over the longer term.

.jpg)

Source: Savills Research | Note: These forecasts apply to average prices in the second-hand market. New build values may not move at the same rate.