Whilst the most expensive markets across prime North West London have been most affected by tax and uncertainty over the last few years, buyers will still pay a significant premium for the best locations

Brexit continues to cause uncertainty

.png)

Prime property values to March 2019

Source: Savills Research

Price falls across prime London continue to slow. The first quarter of 2019 saw a fall of just 0.3%, leaving prices 2.5% lower than a year ago. This is encouraging given the ongoing political turmoil, which remains the biggest challenge in the market according to our agents. While stock levels are subdued, applicants and viewings have increased in the first quarter of this year, suggesting buyers see value in the market but are reluctant to commit until after Brexit.

Price expectations of buyers and sellers have narrowed, keeping the market moving, while location and condition continue to be key selling points. With competitive mortgage rates and a currency advantage for overseas buyers, Brexit negotiations will be pivotal to the market going forward.

The prime North West London region stretches from Hampstead through Primrose Hill to St John’s Wood. Prices in this region saw a small fall of 0.8% over the first quarter of 2019, but were 4.1% lower over the year. Though this region is similar in price and buyer demographic to prime central London, the peak of its market came much later. While the prime North West market saw an initial correction following the stamp duty changes in late 2014, this was short-lived, with the market recovering to hit its peak in September 2015. Since that point, values across prime North West London have fallen by 10.0%, fuelled by uncertainty surrounding Brexit.

.png)

Prime London prices Ongoing Brexit negotiations continue to affect prices across the region

Source: Savills Research | Note: Prices to March 2019

.png)

Price monitor Key statistics for house price growth

Source: Savills Research

Prime North West London in focus

It is the most expensive markets that have been most affected, where buyers are also more discretionary. St John’s Wood, where the average property is £1,600 per sq ft, has seen prices fall by 11.5% since September 2015, while Hampstead, at £1,100 per sq ft, has fallen by 6.8% over the same period.

And this is similarly reflected in the strength of flats over houses. Over the past five years, values for flats have fallen by 6.6% compared with 12.8% for houses.

However, this is not the only factor affecting prices. Being located close to the area’s green space commands a significant premium: for example, properties close to Regent’s Park, on average, command a 24% premium above the region’s average on a £ per sq ft basis, and those next to Primrose Hill a 7% premium.

International schools, such as the American School in St John’s Wood, also act as a strong pull factor. As such, this region is particularly popular with buyers from Europe, South Asia and North America.

These buyers have benefited from sterling’s weakness and price adjustments. For example, a buyer purchasing in prime North West London in US dollars over the last quarter would have saved 10% than if they bought a year ago.

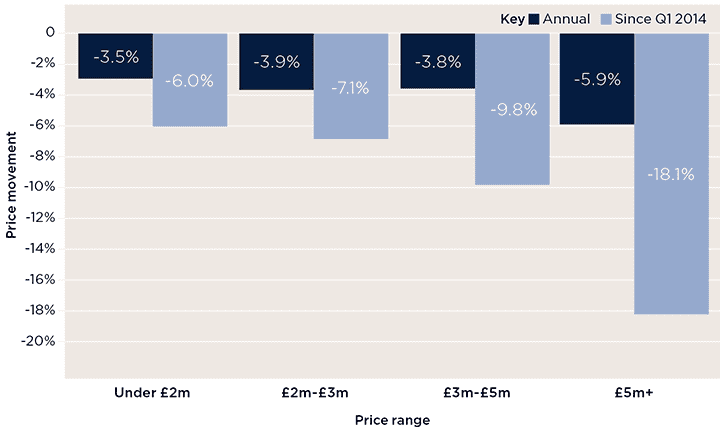

Fall into line Properties below £2m have been the strongest performing

Source: Savills Research

Being close to green space commands a significant premium. For example, properties close to Regent’s Park, on average, command a 24% premium

Savills Research

Outlook

In the short term, the North West London market is likely to remain price sensitive – at least until the uncertainty caused by the ongoing Brexit negotiations comes to a conclusion. Sentiment and confidence are likely to be the driving factors.

However, the appeal of the North West London region to the international market means that there is still an opportunity for those buying in foreign currencies. And the appeal of the green space offered by Regent’s Park and Primrose Hill, as well as the high quality of housing, are likely to remain pull factors for buyers.

.png)

Source: Savills Research | Note: These forecasts apply to average prices in the second-hand market. New build values may not move at the same rate

Interested in other areas of the UK?

View all of our latest prime Market in Minutes research here.

.jpg)