Intensification of existing retail sites represents a significant opportunity to deliver more homes in London

There are two structural shifts in consumer behaviour that are leading to retailers needing less space. First, online shopping continues to grow in popularity. In December 2018, online sales increased by 14% compared with the same period in 2017. Sales online accounted for 18% of all UK retail sales in 2018. For some retailers, this means that fewer stores are needed. For others, it also means a change in their unit space requirements.

The second shift in behaviour is that consumers are spending more on activities and experiences and less on buying ‘material stuff’. Household spend on recreation has expanded 2.5% per year since 2009, exceeding the 0.7% growth in total household expenditure. As such, the retail offering has to be about more than traditional shops; it has to also include leisure and amenities.

These shifts in consumer spending are having a bearing on locations and the elements that make up a place where people want to spend time and money. Rather than complete repurposing of retail, consolidation will be key.

Structural shifts in consumer behaviour are presenting more opportunities for residential development

Savills Research

Stores still drive sales

Despite the changing retail landscape, London and its retail villages continue to be attractive destinations for expanding brands and operators. Physical stores still play an important role in driving sales, particularly online, as well as mitigating some of the downward margin pressures associated with operating online platforms. We estimate that the ‘halo effect’, where online sales touch a physical store, represented 30% of all online sales in 2018, whether that be click and collect or an online purchase where the product had first been seen in store.

There is also an uptick in online sales when a new store opens. A study in the US found a 37% increase in web traffic to retailers’ sites within markets where they had opened new stores.

Although physical retail in London is still a vibrant and important sector, high-supplied areas are not immune to the portfolio rationalisation and shifting unit size requirements we’re seeing in some parts of the retail market. According to Experian data, an estimated 8% of retail floorspace is vacant in London.

Intensifying sites

Beyond the town-centre opportunities, there is potential for further consolidation and intensification on big box retail sites and shopping centres. Diversification and intensification, rather than wholesale repurposing, is likely to be the solution. The opportunity arises from currently vacant floorspace, redeveloping car parking space, and intensifying existing retail. Bringing different uses on site will increase footfall and benefit the remaining retail.

.jpg)

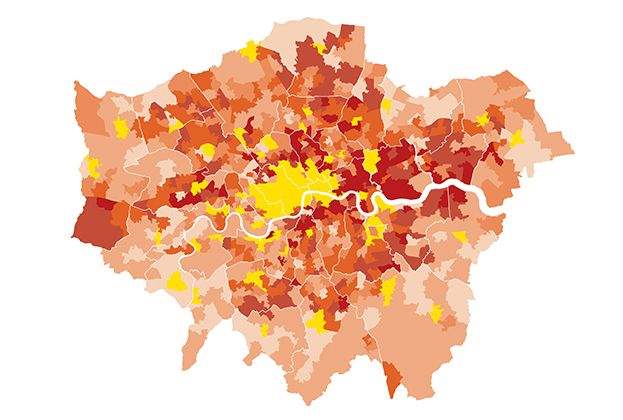

Opportunity for intensification Vacant retail floorspace in areas where average residential new build asking prices are below £700 per square foot (psf)

Source: Savills Research, Molior, EGi, HM Land Registry, Experian | Note: Points plotted as centroid of area

New residential supply

In contrast to retail, London’s residential market is drastically undersupplied. We calculate that 94,000 new homes are needed each year to improve affordability.

It is important to note that this supply-demand imbalance is not spread evenly across the market. Some 87% of this demand – equating to 81,500 homes – is at price points below £700psf and in sub-market housing. The supply-demand shortfall here is 56,643 homes per year.

In London, the greatest opportunity to intensify existing retail sites through large-scale redevelopment happens to fall in areas that can create residential supply at price points where it is needed most. At least 50% of vacant floor space in London’s town centres is in areas where new build pricing is below £700psf.

.jpg)

London annual residential supply/demand 2019-23 50% of vacant retail floor space is in areas where new build pricing is less than £700psf

Source: Savills Research, Molior, CACI, Oxford Economics

Read the other articles within this publication below

.jpg)